October 30, 2023

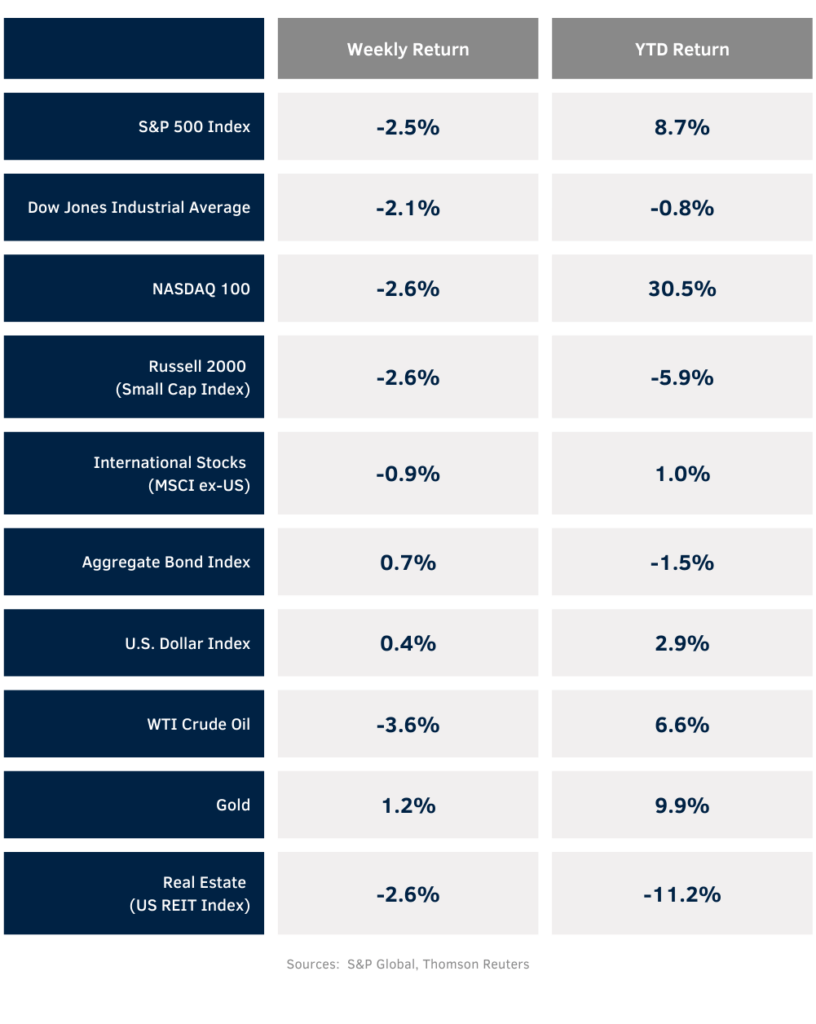

Mixed earnings from the mega cap Technology and Communications Services companies and on-going concerns of events in the Middle East sent equity markets down last week. The weekly return for the S&P 500 Index was -2.5%, the Dow was -2.1%, and the NASDAQ was -2.6%. The Utility sector was the only sector with a positive return for the week. The bottom performing sectors were Health Care, Communication Services, and Energy. The 10-year U.S. Treasury note yield decreased to 4.845% at Friday’s close versus 4.924% the previous week.

Despite a strong third quarter advance Gross Domestic Product (GDP) report, the Federal Reserve is not likely to make changes to the Fed funds rate this week. Current CME futures place a 98.6% probability the Fed will hold rates steady at the November 1st Federal Open Market Committee (FOMC) meeting. While rates may stay higher for longer, the Fed isn’t likely to keep raising rates unless economic activity jeopardizes the progress being made against inflation.

We are halfway through the third quarter earnings reporting period with 245 companies in the S&P 500 Index having reported. Another 164 companies are scheduled to report earnings this week. S&P 500 Index earnings are expected to grow by 4.3% year-over-year on revenue growth of 1.4%. This is an increase from the 1.6% earnings and 0.8% revenue growth forecasted at the start of the earnings reporting period. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.2% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look closer at Third Quarter GDP.

Financial Market Update

Dissecting Headlines: Third Quarter GDP

Third quarter advance GDP increased at an annual rate of 4.9% which is the strongest expansion since late 2021. The growth was largely driven by personal consumption expenditures, which contributed approximately 55% to growth, while private domestic investment and government consumption expenditures and gross investment accounted for approximately 30% and 16% contribution, respectively. The second estimate for third quarter GDP, based on more complete data, will be released on November 29, 2023.

Highlights from the report shows strong growth in several categories from the second quarter GDP report. Some of the highlights include a large personal consumption expenditure increase from 0.8% in the second quarter to 4% in the third quarter. According to the Wall Street Journal, Americans spending on travel, concerts, and movies is still being supported by a strong labor market and residual savings from the past two years while the negative effects of supply chain constraints are improving. As we highlighted back in July, the Taylor Swift tour and summer blockbuster movies helped capture consumer spending dollars.

Private inventories also increased substantially, potentially indicating a healthier balance of inventory being held by businesses anticipating levels of consumer demand. The federal government expenditure on defense also jumped from 2.3% in the second quarter to 8.0% in the third quarter likely fueled by global demand for defense goods. For context, forecasters polled in July of 2023 predicted that the third quarter GDP would be 0.6%. The current forecast for fourth quarter GDP is 0.9%.