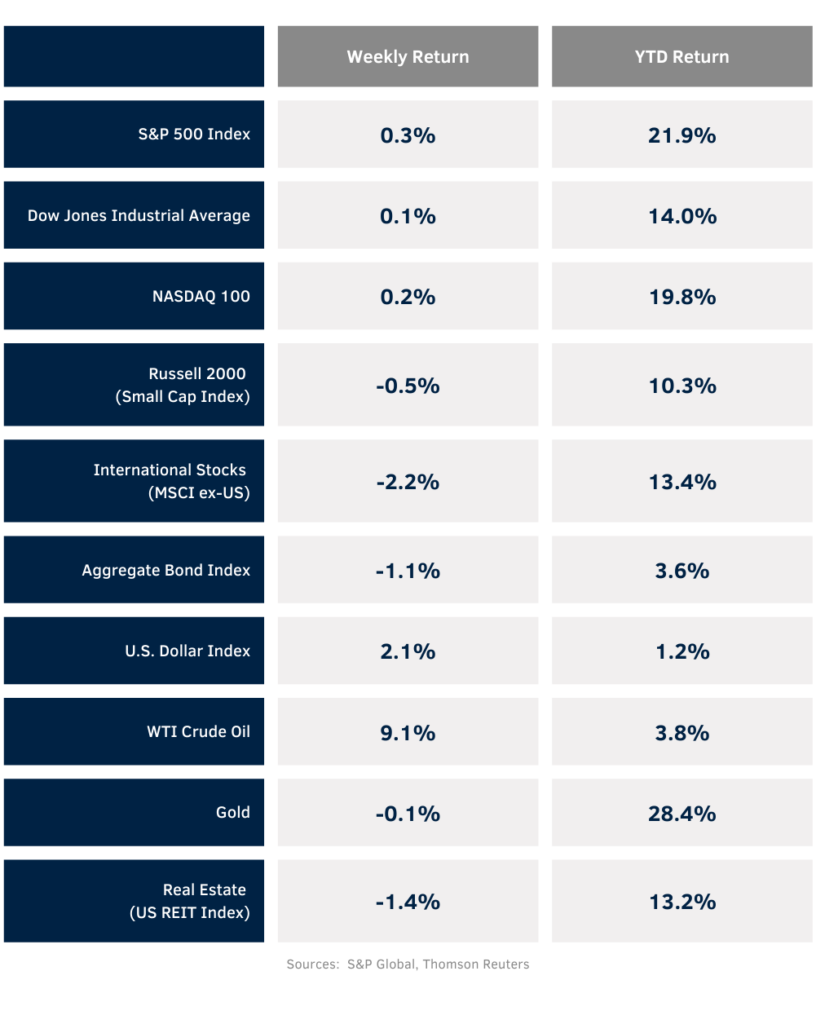

Labor news had an impact on markets last week. The port workers went on strike on Tuesday and then back to work on Friday, and the September labor market report was well above expectations. Stocks labored most of the week before a relief rally on Friday. For the week, the S&P 500 was +0.3%, the Dow was +0.1%, and the NASDAQ was +0.2%. Within the S&P 500 Index, the Energy, Communication Services, and Financial sectors led the market. The Materials, Real Estate, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 3.875% at Friday’s close versus 3.748% the previous week.

The September Employment Situation report showed 254,000 net new jobs created versus an expectation of 135,000. The September unemployment rate decreased to 4.1% from 4.3% in August. Investor reaction to the employment report suggests a soft landing is possible for the economy. CME fed funds futures for November now imply a 0.25% reduction in the fed funds target rate. An additional 0.25% reduction projected for December would bring the year in at a 1.0% reduction which is inline with the FOMC’s recent Summary of Economic Projections.

The third quarter earnings reporting period begins this week with nine companies in the S&P 500 Index scheduled to report earnings. Third quarter earnings growth is currently forecast at 4.2% y/y with revenue growth of 4.8%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.8% with revenue growth of 4.7%.

In our Dissecting Headlines section, we look at current investor sentiment.

Financial Market Update

Dissecting Headlines: Investor Sentiment

On the eve of the quarterly earnings season and presidential election, we wanted to check on investor sentiment from the American Association of Individual Investors (AAII) weekly survey. The survey asks for investors’ opinions of whether the stock market will be up or down in the next six month.

The current survey data for last week shows 45.5% of survey respondents are bullish and 27.3% are bearish. The bullish sentiment is above its 37.5% historical average and the bearish sentiment is below its 31.0% historical average. The spread between bulls and bears is 18.2 percentage points and it has been above its historical average of 6.5 percentage points for 21 of the past 22 weeks, reflecting optimism that has driven the market year-to-date.

Survey respondents were also asked how the election is currently affecting their expectations for the stock market. The majority, 52.2%, said it was making them more cautious. Another 32.9% said it had no impact, and 11.1% said it was making them more optimistic.

We view the above average bullish sentiment coupled with caution over the election as understandable and it feels like the classic Ronald Reagan phrase “cautiously optimistic”. The next month should let us know which half of the phrase winds up being more accurate.