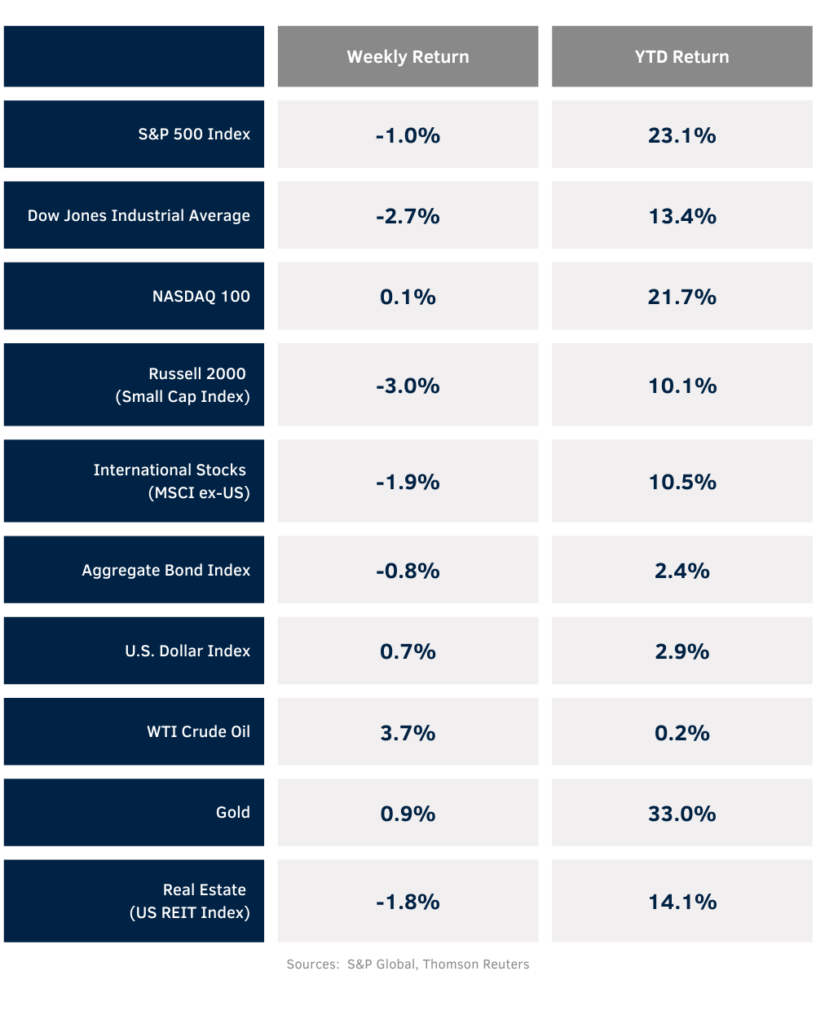

The NASDAQ managed a weekly gain while the S&P 500 and Dow Jones indices declined last week. For the week, the S&P 500 was -1.0%, the Dow -2.7%, and the NASDAQ +0.1%. Within the S&P 500 Index, the Consumer Discretionary, Technology, and Communication Services sectors led the market. The Materials, Health Care, and Industrial sectors lagged. The 10-year U.S. Treasury note yield increased to 4.239% at Friday’s close versus 4.078% the previous week.

Corporate earnings reports, inflation, employment, and GDP data, plus closing arguments from election candidates provide a lot of information to digest this week. Just over one-third of companies in the S&P 500 Index are scheduled to report their earnings results this week. Normally, it would be a great time to focus on fundamental factors, but economic headlines will dominate as well. The September Personal Consumption Expenditures (PCE) Price Index will provide a look at the Fed’s preferred inflation gauge on Thursday and the October Employment Situation Report is scheduled for Friday. We will also see preliminary third quarter GDP data on Wednesday. All this comes just before the Federal Open Market Committee (FOMC) meets on November 6th and 7th for its next decision on monetary policy. Current CME Fed funds futures for November imply a 0.25% reduction in the Fed funds target rate at the meeting. An additional 0.25% reduction in December would bring the year in at a total reduction of 1.0% in the Fed funds rate which is in line with the FOMC’s Summary of Economic Projections. Lastly, headlines are likely to be dominated by the homestretch into election day on November 5th.

The third quarter earnings reporting period continues this week with 169 companies in the S&P 500 Index scheduled to report earnings. Third quarter earnings growth is currently forecast at 3.6% year-over-year with revenue growth of 4.9%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we take a break from the headlines and provide a quick rule of thumb to calculate how long it can take for investments to double.

Financial Market Update

Dissecting Headlines: The Rule of 72

While presidential candidates are focused on the 270 electoral votes they need to win. Investors can win by focusing on the number 72. When thinking about how long it takes for an investment to double in value, a simple math exercise called the Rule of 72 can be used as a guide.

The Rule of 72 states that the number of years required for an investment to double in value is equal to 72 divided by the rate of return. This takes into account the effect of compounding interest, meaning that the same rate of return is applied every year to the total of principal and return from the year prior.

If we take 72 and divide by a 7.2% annual return (drop the percentage sign), the result is a 10 year period for an investment to double. A higher return shortens the period and a lower return lengthens the period. The average annual return of the S&P 500 Index since 1957 (when 500 stocks were adopted as the Index) is around 10.2%. That 10.2% average return would take just over 7 years to double your money.

Additional savings being added or withdrawals taken out over the investment period could alter these numbers, as well as factors such as taxes.