October 9, 2023

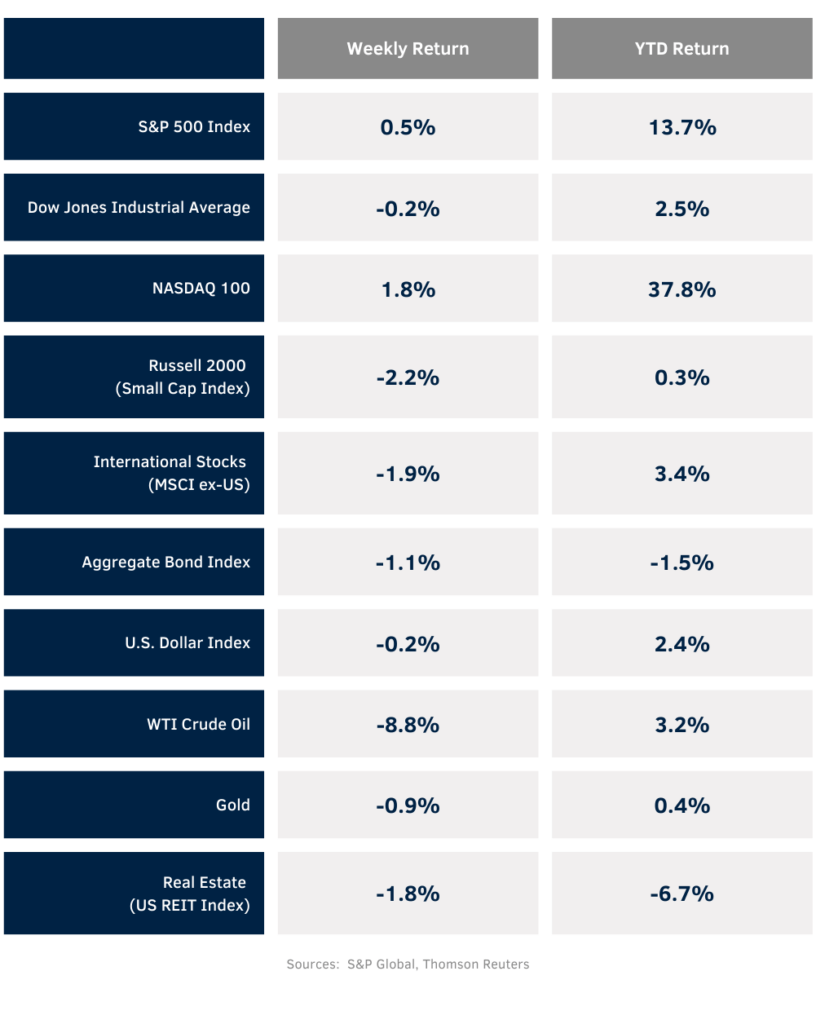

The September Employment report pointed to a still strong economy and sparked a market rally on Friday. The weekly return for the S&P 500 Index was +0.5%, the Dow was -0.2%, and the NASDAQ was +1.8%. The Technology, Communication Services, and Health Care sectors led the market, while the Energy, Consumer Staples, and Utilities sectors were the biggest laggards. The 10-year U.S. Treasury note yield increased to 4.782% at Friday’s close versus 4.571% the previous week.

The September Employment Situation report showed 336,000 jobs created versus an expectation of 170,000. The Unemployment Rate was unchanged from 3.8% in August. Current CME futures place a 78.9% probability the Fed will hold rates steady at the November 1st Federal Open Market Committee (FOMC) meeting.

The market impact of the terror attacks in Israel over the weekend along with reports on September inflation should set the tone for the week.

The third quarter earnings reporting period starts this week with eleven companies in the S&P 500 Index scheduled to report earnings. S&P 500 Index earnings are expected to grow by 1.3% year-over-year on revenue growth of 0.9%. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.3% on revenue growth of 2.1%.

In our Dissecting Headlines section, we look at significant events in the U.S. and abroad that add an extra layer of complexity to the financial markets beyond economics and company earnings.

Financial Market Update

Dissecting Headlines: Here and Abroad

While the main driver of investment returns over time are corporate earnings, there are periods where macroeconomic or geopolitical events can override sentiment in the near-term.

The terror attacks in Israel over the weekend caused a tragic and significant disruption to the economic-focused narrative that investors were considering when digesting the data in the September employment report on Friday. Heading into the new trading week, we see initial actions consistent with the worry over terrorist attacks. Oil is rising, defense stocks are trading higher, airlines stocks are trading lower, and other safe havens such as gold are trading higher. These initial reactions should playout over the week as Israel and other countries respond to the attacks.

Back in the U.S., the ouster of House Speaker Kevin McCarthy last week is also a disruption to the plan to pass a bill to keep the government funded for the fiscal year. A new Speaker is likely to emerge this week, but the clock is already ticking on the 45-day stopgap funding bill that expires on November 17th. While this likely gets done on time, the change in the cast for the political theater is a distraction from the third quarter earnings season that begins this week.