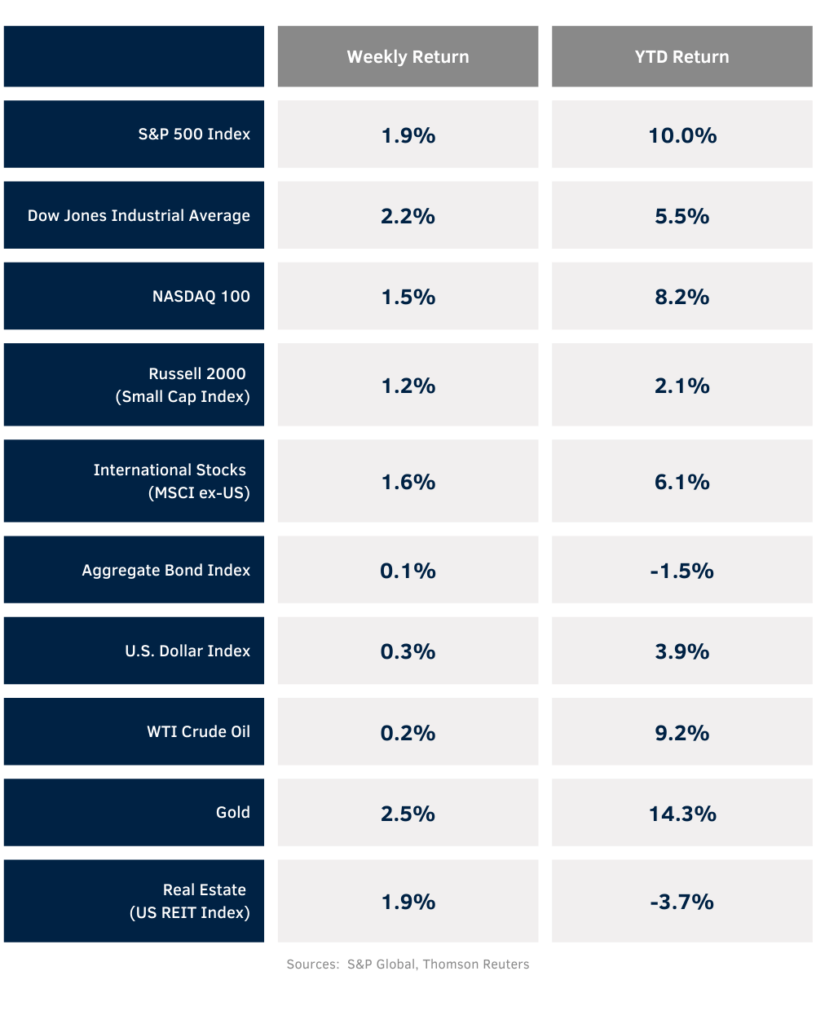

Stocks advanced in a week with little major data to sway sentiment. For the week, the S&P 500 Index was +1.9%, the Dow was +2.2%, and the NASDAQ was +1.5%. Within the S&P 500 Index, the Utility, Financial, and Materials sectors led the advance, while the Consumer Discretionary, Energy, and Technology sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.494% at Friday’s close versus 4.503% the previous week.

Inflation data is back on the table this week with the April Producer Price Index (PPI) scheduled for release on Tuesday and Consumer Price Index (CPI) on Wednesday. CME Fed Funds futures are predicting no change in monetary policy at the next two FOMC meetings in June and July. The current probability for an initial rate cut is in September.

We are almost complete with the first quarter earnings reporting season with 92% of companies in the S&P 500 Index having reported results. 78% of companies reporting have reported a positive earnings surprise and 59% have reported a positive revenue surprise. For the coming week, seven companies in the S&P 500 Index are scheduled to report earnings. The current first quarter consensus forecast for the S&P 500 Index is 5.4% earnings growth with revenue growth of 4.1%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.1% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at Mother’s Day shopping trends.

Financial Market Update

Dissecting Headlines: Mother’s Day Shopping

While not as significant a spending period as the Christmas shopping season, 84% of Americans do some specific spending for Mother’s Day. According to the National Retail Federation (NRF), Mother’s Day spending is forecast to be $33.5 billion this year. That is expected to be slightly below 2023’s record of $35.7 billion.

The average spend per person is expected to be $254.04, also slightly down from $274.02 last year. Most spending is done for a mother or step-mother at 59%, followed by a wife at 22%, and a daughter at 12%. The most popular gifts are flowers at 74%, greeting cards also at 74%, and taking the honored woman to dinner or brunch at 59%. The top categories by dollars spent are jewelry at $7 billion, dinner/brunch at $5.9 billion, and electronics at $3.5 billion.

Optimove Insights identified that consumers prioritize quality and personalization over price when shopping for Mother’s Day.

Online remains an important shopping venue with 35% of respondents to the NRF’s survey saying they shopped online for Mom, followed by department stores at 32%, specialty stores at 29%, and local or small businesses at 25%.

The rolling calendar of event-driven consumer spending is important to monitor as a gauge of health of the consumer and its impact on the economy. Upcoming significant spending as we stretch into the summer months is holiday travel, specifically over Memorial Day, Independence Day, and Labor Day, as well as back-to-school spending starting in late July to early August.