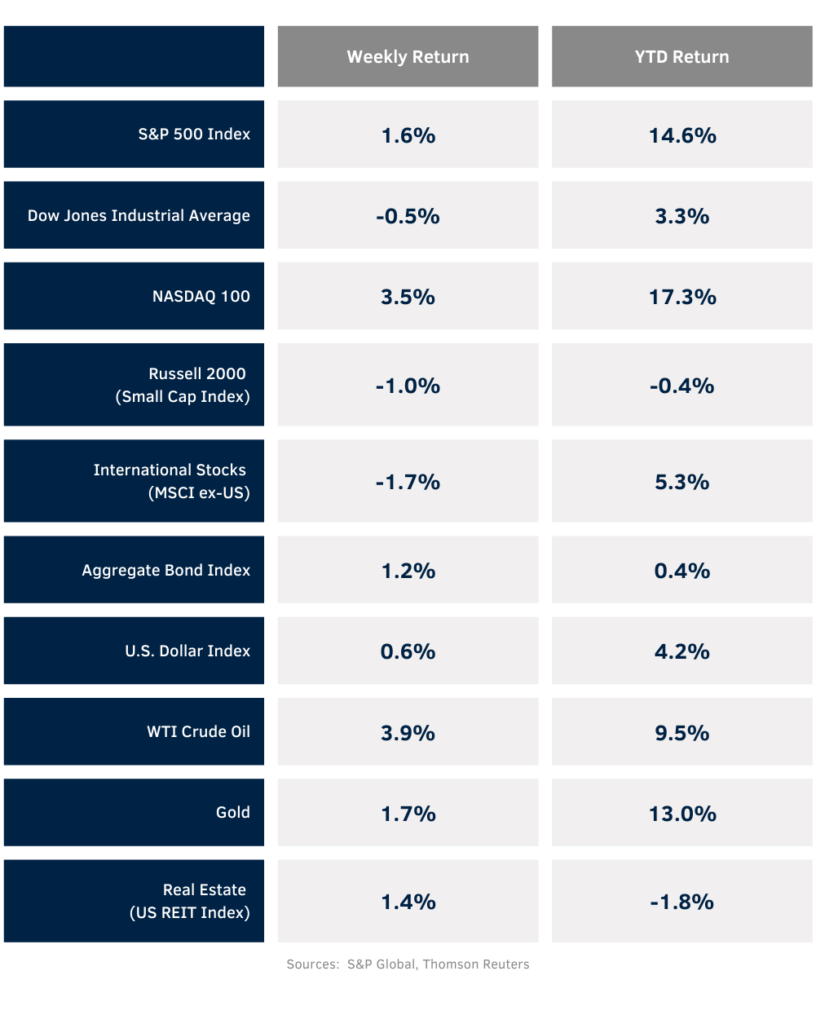

Tame inflation data led the S&P 500 and NASDAQ higher last week, even though the Federal Reserve dialed back its projections for interest rate reductions . For the week, the S&P 500 Index was +1.6%, the Dow was -0.5%, and the NASDAQ was +3.5%. Within the S&P 500 Index, the Technology, Real Estate, and Consumer Discretionary sectors led, while the Energy, Financials, and Industrial sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.209% at Friday’s close versus 4.431% the previous week.

May inflation data came in below consensus expectations. The Consumer Price Index (CPI) was flat month-over-month and +3.3% year-over-year and core CPI, which excludes food and energy prices, was +0.2% month-over-month and +3.4% year-over-year. The Producer Price Index (PPI) was -0.2% month-over-month and +2.2% year-over-year. Core PPI, which excludes food, energy, and trade prices, was flat month-over-month and +3.2% year-over-year.

The Federal Open Market Committee (FOMC) held the Fed funds rate at its current 5.25% to 5.50% target range at its June meeting. In its quarterly update to the Summary of Economic Projections the Committee revised its year-end Fed funds target range to a 5.00% to 5.25% range versus previous target range of 4.50% to 4.75%. Based on CME Fed funds futures, the probability of a September rate cut is currently 68.5%. Futures also imply a second rate cut by year end, contrary to the Fed’s current projections.

Second quarter earnings reports start in a few weeks. For the second quarter, earnings growth is expected be 9.0% higher year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the FOMC’s updated Summary of Economic Projections.

Financial Market Update

Dissecting Headlines: Summary of Economic Projections

At the conclusion of FOMC meetings in March. June, September, and December the Committee updates its Summary of Economic Projections. The projections cover FOMC projections for economic growth as measured by Gross Domestic Product (GDP), the labor market as measured by the unemployment rate, and inflation as measured by the Personal Consumption Expenditures (PCE) Price Index. The Committee also publishes what it believes is an appropriate monetary policy path for short-term interest rates.

The current 2024 projections are GDP growth of 2.1%, the unemployment rate at 4.0%, PCE inflation 2.6% higher and core PCE, which excludes food and energy prices, 2.8% higher. The GDP and unemployment forecasts are consistent with the previous update from March, while the PCE forecast was raised to 2.6% from 2.4% and the core PCE was raised to 2.8% from 2.6%. The stickiness of inflation also prompted the FOMC to reduce the number of interest rates cuts for 2024 with the year-end Fed funds target rate at a 5.00% to 5.25% range from a previous projection of 4.50% to 4.75%. This implies only a single 0.25% reduction from the current range of 5.25% to 5.50%.

For 2025, the Committee currently projects GDP leveling at 2.0% growth, unemployment inching up to 4.2%, and the rate of inflation receding on PCE and core PCE Prices to 2.3% year-over-year. While early, the Committee also forecasts the Fed funds rate to decline by a full percentage point to a 4.00% to 4.25% range by the end of 2025.

The Federal Reserve will likely stay data dependent and we can look for additional fine tuning of these projections and monetary policy following the September FOMC meeting.