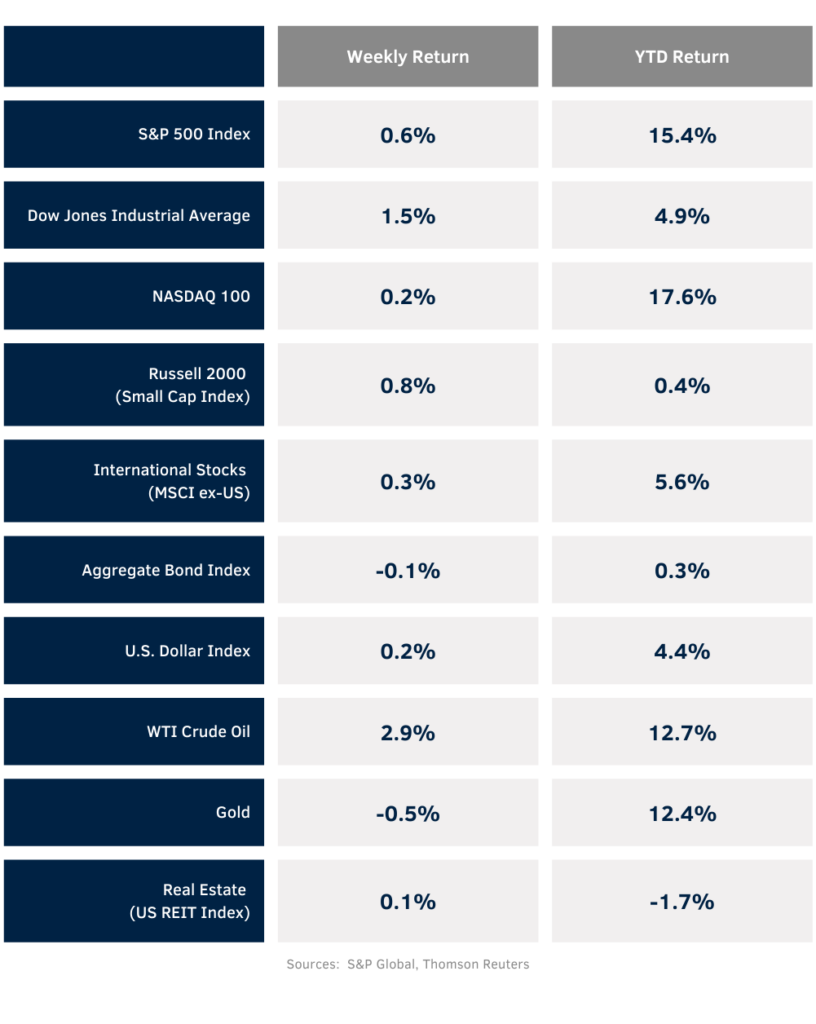

Stocks posted gains during the holiday shortened week. For the week, the S&P 500 Index was +0.6%, the Dow was +1.5%, and the NASDAQ was +0.2%. Within the S&P 500 Index, the Consumer Discretionary, Energy, and Financial sectors led, while the Utility, Real Estate, and Technology sectors lagged. The 10-year U.S. Treasury note yield increased to 4.253% at Friday’s close versus 4.209% the previous week.

Key economic data out this week includes the Personal Consumption Expenditures (PCE) Price Index for May, set for release on Friday. Investors will be looking for signs that inflation is on a sustainable path toward the Fed’s 2% target. Based on CME Fed funds futures, the probability of a September rate cut is currently 65.9%. Futures also imply a second rate cut by year end, contrary to the Fed’s current projections.

Six companies in the S&P 500 Index are scheduled to report second quarter earnings this week. For the second quarter, earnings growth is expected be 8.8% higher year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the American Automobile Association’s (AAA) forecast for Independence Day travel.

Financial Market Update

Dissecting Headlines: Independence Day Travel

The American Automobile Association’s (AAA) Independence Day travel forecast projects a new record with 70.9 million people planning to travel more than 50 miles from home. This is 5.2% higher than last year and surpasses 2019’s pre-pandemic level by 8.7%.

The main mode of transportation is expected to be automobile with 60.6 million travelers. This is a 4.8% increase from 2023 and a 9.6% increase from 2019. Current gasoline prices are averaging $3.448/gallon. This is 3.6% lower year-over-year, so while inflation remains resilient in several consumer categories, there is some relief at the pump for holiday driving.

Air travel is expected to see 5.74 million travelers. This is a 6.9% increase from 2023 and a 12.3% increase from 2019. Based on data from the May Consumer Price Index (CPI), air fares are 5.9% lower year-over-year.

Other travel categories are also seeing some deflation year-over-year with hotel and motel prices down 1.7% and car rental prices down 8.8%. Food away from home is higher by 4.0% year-over-year.

With July 4th falling on a Thursday this year, there is likely to be travel demand on both weekends bookending the holiday. Travel remains a strong component of overall consumer spending.