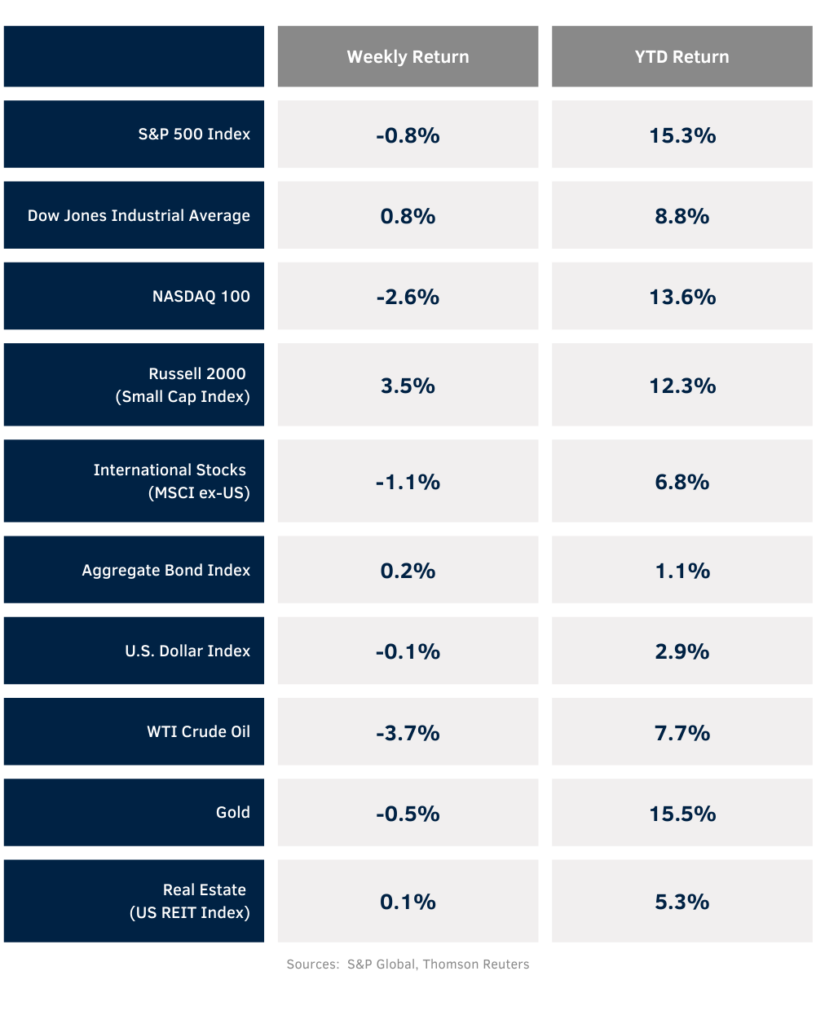

The rotation continued last week with small cap stocks outpacing large cap stocks, especially in the technology sector. The Russell 2000 Index was +3.5% for the week, while the Dow was the only positive major average +0.8% and the S&P 500 fell 0.8% and the NASDAQ fell 2.6%. Within the S&P 500 Index, the Utilities, Health Care, and Materials led, while the Communication Services, Technology, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.196% at Friday’s close versus 4.239% the previous week.

All eyes on the Federal Reserve this week as the Federal Open Market Committee (FOMC) holds a two-day meeting on Tuesday and Wednesday. CME Fed funds futures show no likelihood of any change in interest rates at the meeting, but instead show an initial rate cut at the September meeting and up to two additional rate cuts before year-end. Recent economic data is supportive as it shows inflation slowing moving toward the Fed’s 2% target with the June Personal Consumption Expenditures (PCE) Price Index at +2.5% year-over-year and core PCE at +2.6%. The PCE Price Index is the inflation measure the Federal Reserve references in its goal of returning to an annual inflation rate of 2%.

The flurry of second quarter earnings reports continues this week with 171 companies in the S&P 500 Index scheduled to report earnings. For the second quarter, earnings growth is expected be 9.8% higher year-over-year with revenue growth of 5.0%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.9% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the options for the FOMC.

Financial Market Update

Dissecting Headlines: FOMC Options

The FOMC has not made a change in its interest rate policy since July of 2023. The July 2023 meeting saw the Fed funds target rate increased to its current 5.25% to 5.50% range. This capped a move from March 2022 to July 2023 that saw the Fed funds rate increase from a 0.00% to 0.25% range over twelve meetings as the FOMC seemed to be behind the inflation curve. Investors are widely expecting rates to remain in the current 5.25% to 5.50% range at the conclusion of the FOMC meeting this week, but that may be the last in the string of pauses since September 2023.

At the time of the first rate increase in March 2022, inflation was at a +6.1% annual rate based on the PCE Price Index and the unemployment rate was 3.8%. As mentioned above, the current PCE Price Index is +2.5%, and the most recent reading on unemployment is 4.1%. While not at the FOMC’s targets, the data shows inflation and unemployment are trending in the directions that the Committee wants to see in order to be comfortable departing from its current policy path. The concern expressed by FOMC members has been that lowering rate too early could increase the rate of inflation and waiting too long could let the economy slip too far.

Since the numbers aren’t where they want to see them yet, the FOMC can keeps rates steady this week. If the data by mid-September continues trending in the right directions, we could see the pause come to an end. The September meeting also gives the FOMC the opportunity to reset expectations for the remainder of the year when it publishes the next update to its Summary of Economic Projections.