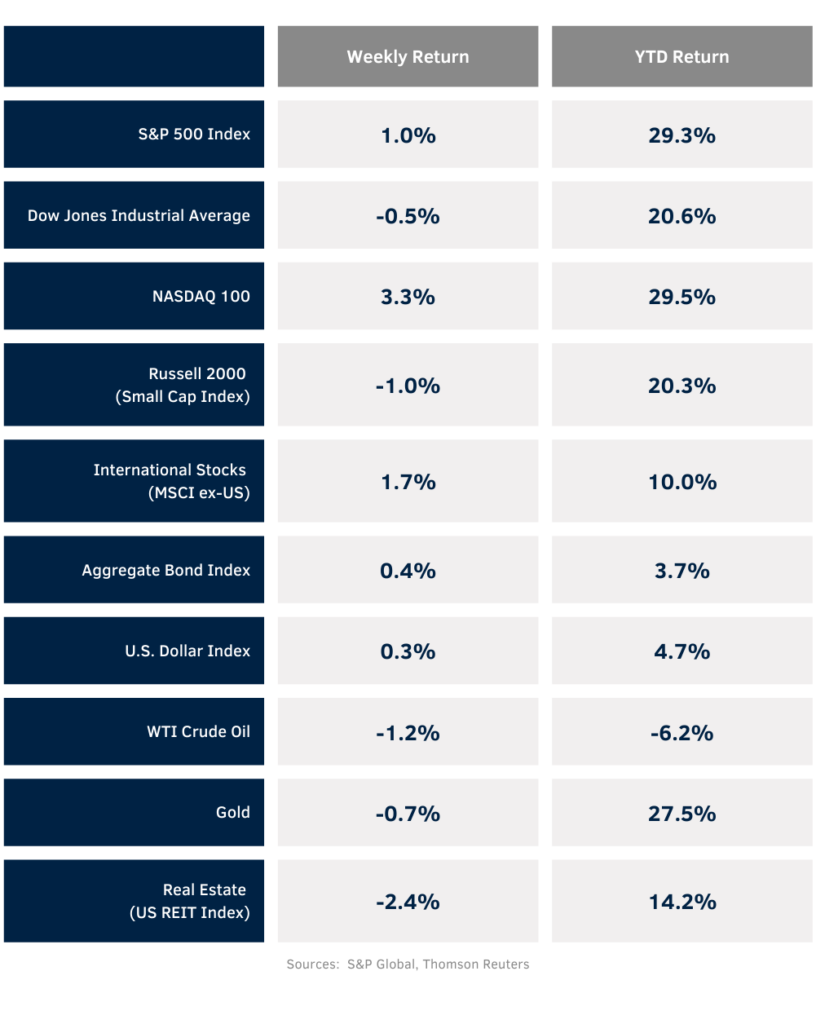

The November rally continued into the first week of December. For the week, the S&P 500 was +1.0%, the Dow Jones Industrials -0.5%, and the NASDAQ +3.3%. The Consumer Discretionary, Communication Services, and Technology sectors led the market, while the Energy, Utility, and Materials sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.149% at Friday’s close versus 4.193% the previous week.

The November Employment Situation Report showed 227,000 new jobs created versus expectation for 210,000. The unemployment rate increased to 4.2% from 4.1% in October. This week brings data on November inflation with the CPI report scheduled for Wednesday and PPI report scheduled for Thursday. Reasonable data on inflation, coupled with the employment report, should set the stage for a 0.25% interest rate cut to a 4.25% to 4.50% target range at the December 18th Federal Reserve meeting. Current CME Fed funds futures show an 87% probability of the 0.25% rate cut, up from 62% a week ago. The Fed should also issue an updated Summary of Economic Projections at the meeting, providing a road map for the first quarter of 2025. Fed funds futures for the first quarter currently show a 0.25% reduction in interest rates.

We end the third quarter earnings reporting period and begin the fourth this week. Two companies in the S&P 500 Index are scheduled for third quarter and four are scheduled for fourth quarter results. Fourth quarter earnings growth is currently forecast at 11.9% year-over-year with revenue growth of 4.8%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.6% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at new administration’s 3-3-3 Plan for the Treasury Department.

Financial Market Update

Dissecting Headlines: Treasury 3-3-3

President-elect Trump’s nominee to serve as Treasury Secretary, Scott Bessent, has outlined a “3-3-3” economic plan that would seek to reduce budget deficits while boosting economic growth and energy production.

The first “3” targets cutting the budget deficit to 3% of GDP by 2028 versus the current level of 6.7%. Streamlining of the budget and cutting unnecessary government spending was a key focus of the campaign and has since manifested itself into the Department of Government Efficiency (DOGE).

The second “3” is boosting GDP growth to a sustainable 3% versus 2.8% currently via deregulation and other pro-growth policies. The combination of lower government spending and higher growth should help with the deficit reduction.

The third “3” is to increase U.S. energy production to the equivalent of an additional 3 million barrels of oil per day. Current U.S. oil production in the 13.0 to 13.5 million barrel per day range. This goal fosters both energy independence and lowers energy costs to both businesses and consumers.

The 3-3-3 plan is a version of the plan to improve the Japanese economy proposed by late Japanese Prime Minister Shinzo Abe, dubbed the “three arrows” plan. Abe’s plan involved aggressive monetary policy and fiscal stimulus, along with reforms to structurally improve Japan’s economy and stimulate growth.

Bessent is also in favor of extending the Tax Cuts and Jobs Act of 2017. Prediction market Kalshi currently shows Bessent with a 93% probability of being confirmed as Treasury Secretary. His nomination is not nearly as controversial as some other potential cabinet positions in the new administration.