October 23, 2023

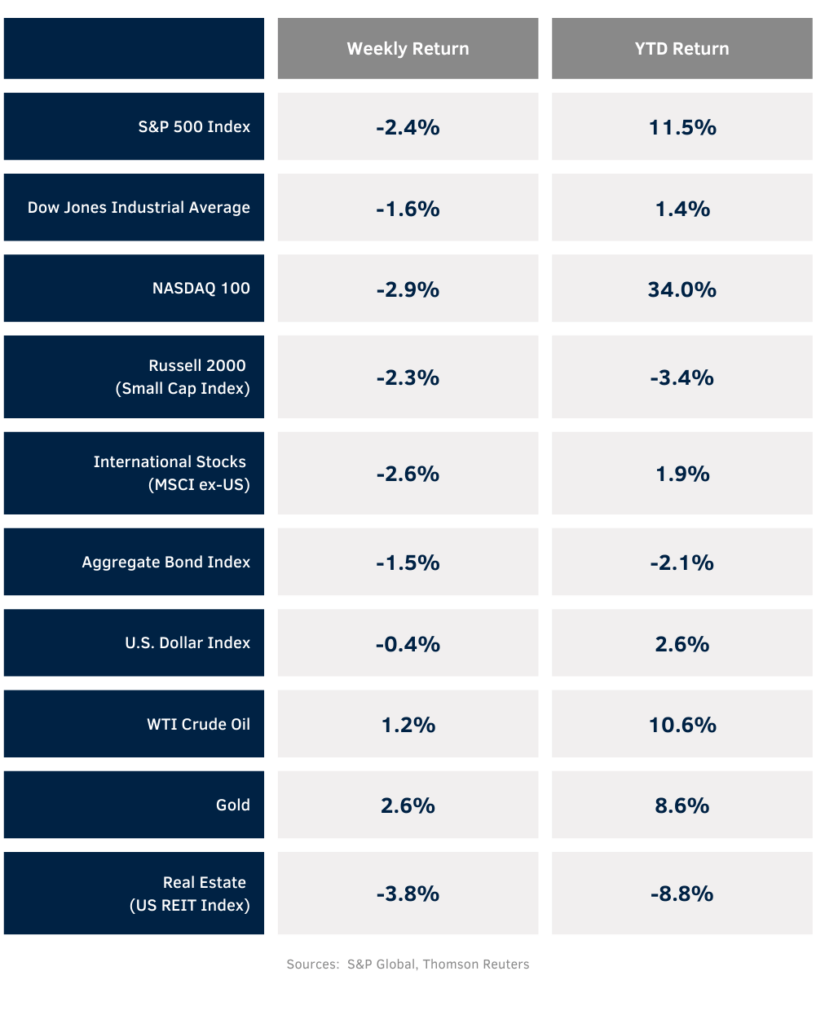

Concerns over widening violence in the Middle East pressured financials markets last week. The weekly return for the S&P 500 Index was -2.4%, the Dow was -1.6%, and the NASDAQ was -2.9%. The Energy sector was the only sector with a positive return for the week. The bottom performing sectors were Health Care, Materials, and Consumer Discretionary. Both crude oil and gold rose during the week. The 10-year U.S. Treasury note yield increased to 4.924% at Friday’s close versus 4.629% the previous week.

Fed Chair Jerome Powell suggested that he is pleased with inflation’s decline and that the Federal Open Market Committee (FOMC) is unlikely to raise short-term interest rates again unless it sees clear evidence that stronger economic activity jeopardizes the fight against inflation. He stopped short of officially declaring an end to the current monetary policy tightening cycle. Current CME futures place a 98.5% probability the Fed will hold rates steady at the November 1st FOMC meeting. A key economic report scheduled for this week is the September Personal Consumption Expenditures (PCE) Price Index on Friday.

The third quarter earnings reporting period continues this week with 158 companies in the S&P 500 Index scheduled to report earnings. S&P 500 Index earnings are expected to grow by 1.1% year-over-year on revenue growth of 1.0%. For full-year 2023, S&P 500 Index earnings are expected to grow by 1.8% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look at the how the third quarter earnings period has progressed as earnings reports ramp up over the coming two weeks.

Financial Market Update

Dissecting Headlines: Earnings Progression

The pace of third quarter earnings reports ramps up this week with 158 companies in the S&P 500 Index scheduled to report earnings. Of the 86 companies that have already reported, 77.9% have reported earnings above consensus expectations. According to data from IBES, for the companies that have reported earnings there has been an aggregate 6.9% upside surprise versus consensus expectations. Upside surprises have been highest in the Financial sector with a 9.6% surprise and the Technology sector with a 7.7% surprise. The only negative surprise so far has been in the Real Estate sector.

While oil prices have risen recently, companies in the Energy sector are facing an expected earnings decline of 33.2% since prices were lower during the comparative reporting period, July to September 2023 versus 2022. Excluding the negative impact of the Energy sector, third quarter earnings for the S&P 500 would be +5.7% versus the current +1.1% growth forecast. In addition to the Energy sector, third quarter earnings are currently expected to decline in the Materials (-20.6%), Health Care (-19.5%), and Real Estate (-7.8%) sectors The highest year-over-year growth is forecast for the Communication Services sector (+34.6%), Consumer Discretionary (+22.1%), Financial (+18.1%), and Utilities (+10.7%).

S&P 500 Index earnings for full-year 2023 are currently forecast to grow by 1.8% and the early forecast for full-year 2024 is earnings growth of 12.5%.