October 16, 2023

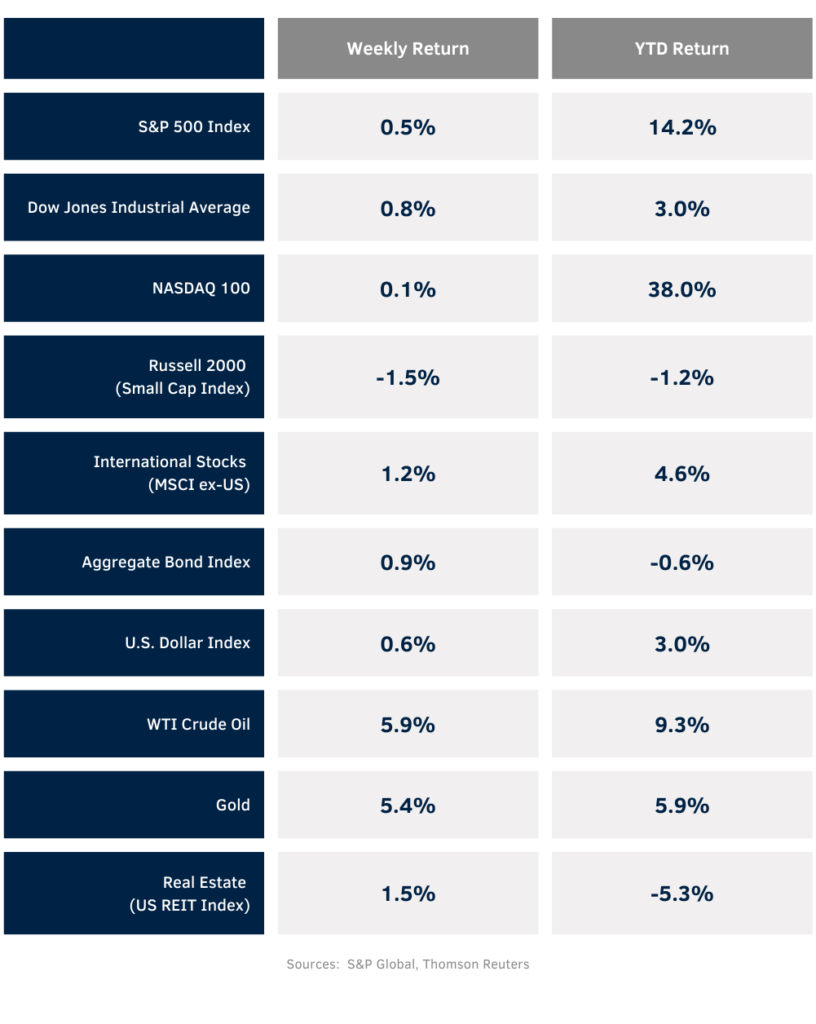

The eruption of violence in the Middle East created a demand for safe haven assets last week as treasury bonds, gold, and oil all rose. The weekly return for the S&P 500 Index was +0.5%, the Dow was +0.8%, and the NASDAQ was +0.1%. The Energy, Utilities, and Real Estate sectors led the market, while the Consumer Discretionary and Materials sectors were negative for the week. The 10-year U.S. Treasury note yield declined to 4.629% at Friday’s close versus 4.782% the previous week.

The September Consumer Price Index (CPI) was +0.4% month-to-month and +3.7% year-over-year. Core CPI, which excludes food and energy prices, was +0.3% month-to-month and +4.1% year-over-year. The year-over-year core CPI at +4.1% is still above the Federal Reserve’s target range but trending in the right direction. Current CME futures place a 90.2% probability the Federal Reserve will hold rates steady at the November 1st Federal Open Market Committee (FOMC) meeting.

The third quarter earnings reporting period continues this week with 56 companies in the S&P 500 Index scheduled to report earnings. S&P 500 Index earnings are expected to grow by 2.2% year-over-year on revenue growth of 1.0%. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.2% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look closer at September CPI to see where inflation is impacting consumers.

Financial Market Update

Dissecting Headlines: Inflation

The rate of inflation has been trending in the right direction since recent peak levels seen in the summer of 2022. We are currently in a mixed inflationary environment. Some categories of goods and services have seen prices continue to climb at an above average pace, some are seeing moderating increases, and some are seeing lower prices year-over-year. Several of the changes are related to changes in supply chain, interest rates, labor costs or consumer patterns.

Shelter prices are higher year-over-year, but many household goods categories to include furniture and appliances are lower. New car prices are moderately higher year-over-year, but the price of used vehicles has declined significantly. The cost of motor vehicle insurance and motor vehicle service has increased significantly year-over-year and gasoline prices are up moderately year-over-year.

Within food cereals and grain prices are higher year-over-year, along with beef and vegetable prices. Milk, eggs, pork, chicken and seafood have seen prices decline year-over-year.

In service categories, prices are higher year-over-year in some recreational expenses to include concert and movie tickets and legal expenses. Service prices are lower year-over-year in airline fares and medical care services.