October 2, 2023

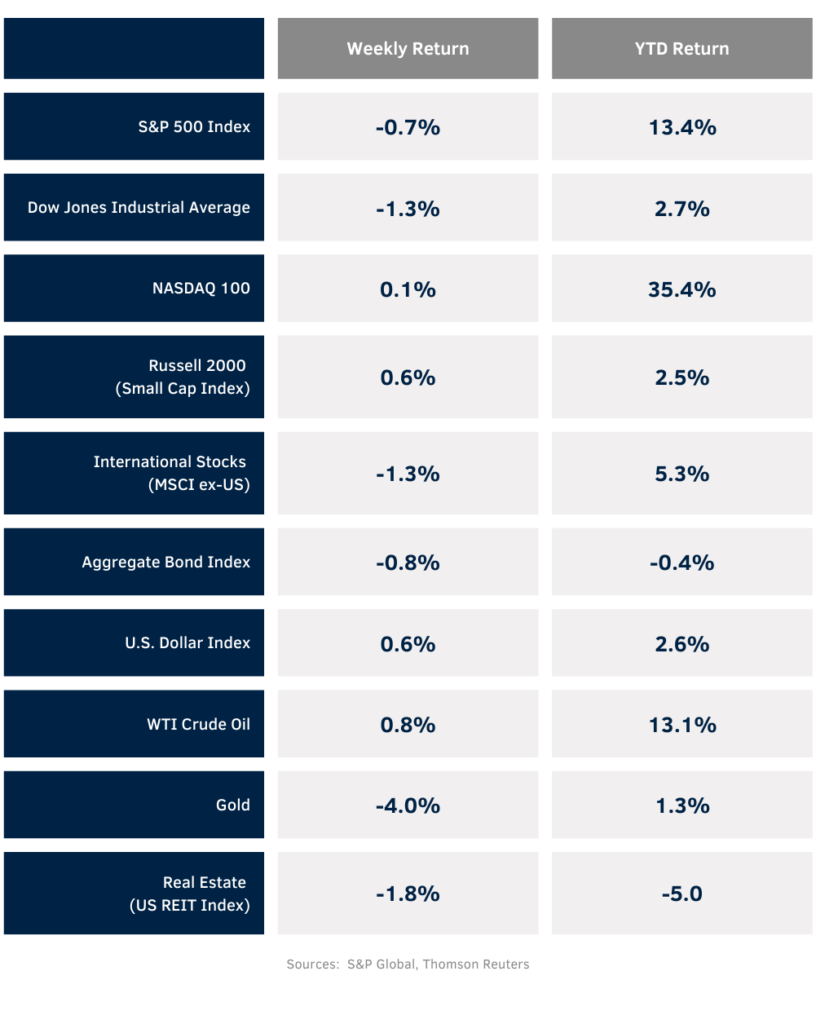

The U.S. government avoided an October 1st shutdown but legislators were only able to agree on a 45-day extension. The weekly return for the S&P 500 Index was -0.7%, the Dow was -1.3%, and the NASDAQ was +0.1%. The Energy, Materials, and Consumer Discretionary sectors were the only positive sectors in the S&P 500 Index, with the remaining eight sectors negative for the week. The 10-year U.S. Treasury note yield increased to 4.571% at Friday’s close versus 4.440% the previous week.

August Personal Consumption Expenditures (PCE) Prices increased by 0.4% month-to-month due to higher energy prices, but core PCE Prices which exclude the impact of food and energy rose only 0.1% month-to-month. The slower rise in core inflation is a welcome sign. The September employment report is scheduled for this Friday and should add another data point for the Federal Reserve to consider ahead of its November 1st Federal Open Market Committee (FOMC) meeting. Current Chicago Mercantile Exchange (CME) futures place a 74.3% probability the Fed will hold rates steady at the November 1st FOMC meeting.

For the upcoming third quarter earnings reporting period, S&P 500 Index earnings are expected to grow by 1.6% year-over-year on revenue growth of 0.8%. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.4% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look at the earnings growth projections for the S&P 500 sectors heading into the third quarter reporting period.

Financial Market Update

Dissecting Headlines: Third Quarter Earnings Forecast

The S&P 500 Index is expected to return to positive earnings growth in the third quarter with 1.6% earnings growth on 0.8% revenue growth. This is a positive reversal from the second quarter which saw earnings decline 2.8% year-over-year. Much of the drag in the second quarter was due to the energy sector which saw earnings decline due to lower commodity prices year-over-year. Seven of the eleven S&P 500 sectors grew earnings year-over-year in the second quarter.

For the third quarter, the same seven sectors are expected to grow earnings led by the communication services sector with 34.0% earnings growth, followed by the consumer discretionary sector with 23.0% growth. The utilities sector is forecast at 12.4% earnings growth and the financials sector is forecast at 11.9% earnings growth. Rounding out the growing sectors is the industrial sector at 8.6% growth, the information technology sector at 5.9%, and the consumer staples sector at 1.3%.

The four sectors expected to contract in earnings growth are the energy sector at –35.0%, materials at –20.5%, health care at –9.7%, and real estate at –7.1%. These are the same four sectors which experienced an earnings contraction in the second quarter.