December 4, 2023

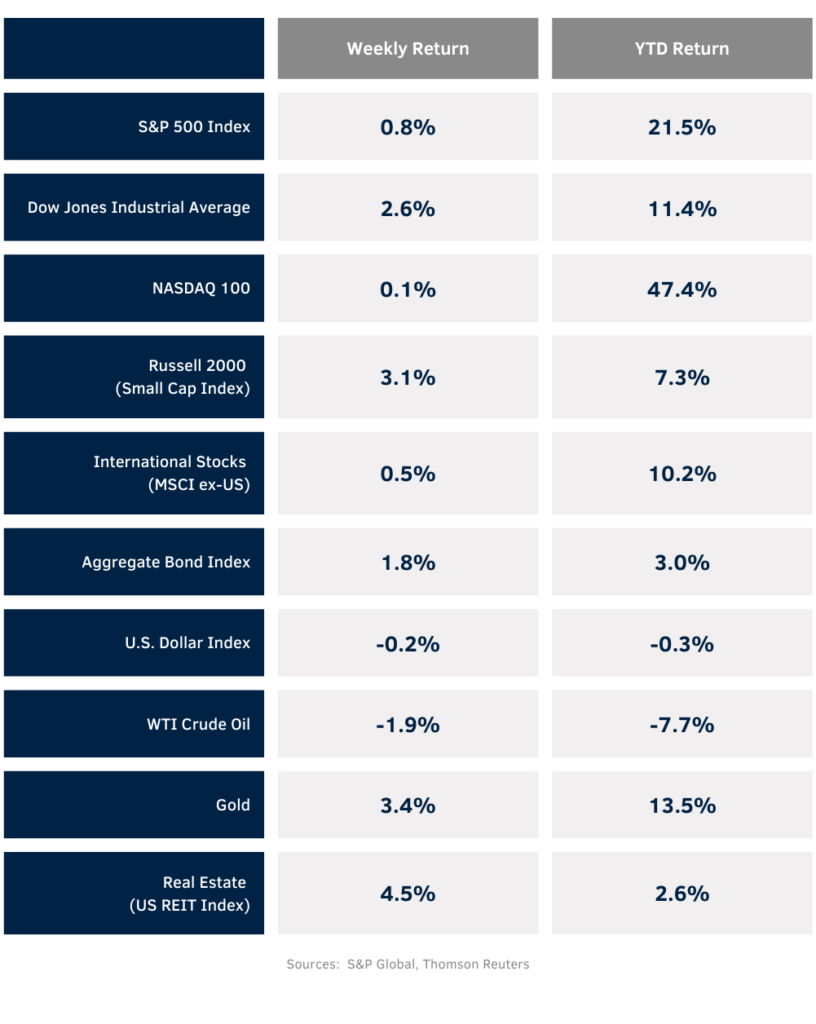

Equities rose and bond yields fell as investors continue to press the case that the Federal Reserve is likely done with the current monetary tightening cycle. The weekly return for the S&P 500 Index was +0.8%, the Dow was +2.6%, and the NASDAQ was +0.1%. The S&P 500 Index was led by the Real Estate, Materials, and Industrial sectors. The Communications Services and Energy services lagged. The 10-year U.S. Treasury note yield decreased to 4.224% at Friday’s close versus 4.484% the previous week.

Federal Reserve Chairman Jerome Powell commented on Friday that inflation “is moving in the right direction,“ but added, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.“ Investors clung to the dovish side of the comment. Based on Chicago Mercantile Exchange (CME) futures contracts, expectations for the Federal Open Market Committee (FOMC) to hold rates steady at the December meeting are currently 97.5% and that the Fed funds rate could start to decline in March. Key data points ahead are the November Employment Situation Report scheduled for this Friday and the November Consumer Price Index (CPI) report scheduled for the following Tuesday, both prior to the FOMC’s next rate decision on December 13th.

With 490 companies in the S&P 500 Index complete on third quarter earnings reporting, S&P 500 earnings are expected to grow by 7.2% y/y on revenue growth of 1.7% for the quarter. This is a substantial increase from the 1.6% earnings and 0.8% revenue growth forecasted at the start of the earnings reporting period. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.6% on revenue growth of 2.0%. Looking ahead, current consensus for full-year 2024 is 11.4% earnings growth on 5.1% revenue growth.

In our Dissecting Headlines section, we look at the Santa Claus Rally.

Financial Market Update

Dissecting Headlines: Santa Clause Rally

The stock market’s strong upside move in November had several commentators as if it was the Santa Claus Rally. It certainly was a gift after the declines seen from August through October, and the giant lump of coal that was 2022. If this was the Santa Claus Rally, it came early this year.

According to the Stock Trader’s Almanac, the actual Santa Claus Rally time period measures the five final trading days of the year and the first two trading days of January. Since 1950, the S&P 500 Index has recorded a positive return on 58 occasions, or 80% of the time, during that time period. The average increase over those seven trading days has been +1.3%.

Whether it is optimism surrounding the U.S. consumer spending money, institutional positioning ahead of the new year, or just the holiday spirit, the impact has been a positive one over the years. This year, the FOMC certainly has the potential to bring joy to all by issuing a more favorable outlook for interest rates at the conclusion of its meeting on December 13th. As mentioned above, a look at the data over the next week could give us a sneak peek.