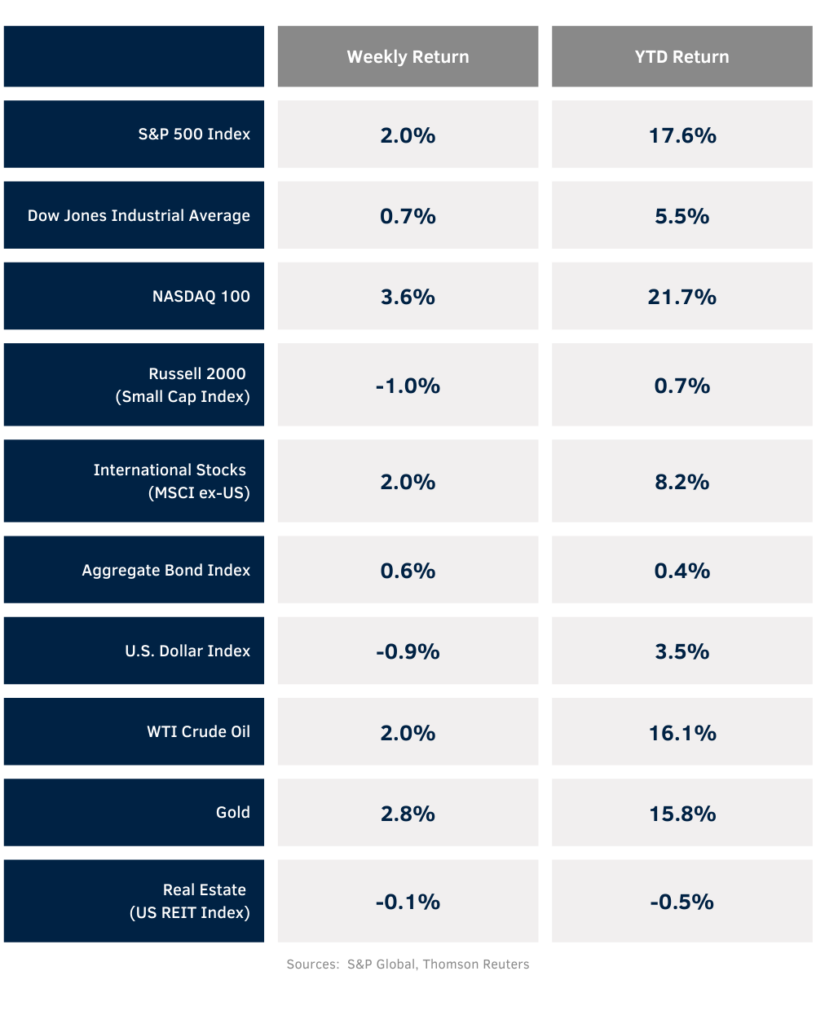

Stocks advanced to start the third quarter. For the week, the S&P 500 Index was +2.0%, the Dow was +0.7%, and the NASDAQ was +3.0%. Within the S&P 500 Index, the Consumer Discretionary, Technology, and Communication Services sectors led, while the Energy, Health Care, and Industrial sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.278% at Friday’s close versus 4.370% the previous week.

The June Employment Situation Report showed 206,000 net new jobs created versus an expectation of 170,000. The May report was revised down to 218,000 jobs from 272,000 previously. The June unemployment rate increased to 4.1% from 4.0% in May. The report gave investors confidence the Federal Reserve may be able to start lowering short-term interest rates this year. Based on CME Fed funds futures, the probability of a September rate cut is currently 73.9%. Futures also imply a second rate cut by year end, contrary to the Fed’s current projections.

Fed Chairman Jerome Powell will provide reports to the Senate Banking Committee and the House Finance Committee this Tuesday and Wednesday. Investors will also be able to assess June inflation data this week with the Consumer Price Index (CPI) scheduled for Thursday and the Producer Price Index (PPI) scheduled for Friday.

Second quarter earnings reports start flowing this week with ten companies in the S&P 500 Index scheduled to report earnings. For the second quarter, earnings growth is expected be to 8.8% higher year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.2% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the sector level earnings expectations for the S&P 500 Index.

Financial Market Update

Dissecting Headlines: Sector Earnings

Second quarter earnings for the S&P 500 Index are forecast to grow 8.8% year-over-year with revenue growth of 4.6%. This would be the fourth consecutive quarter of earnings growth following the earnings recession experienced in the first and second quarters of 2023.

Eight of the Index’s eleven sectors are forecast to show positive earnings growth in the second quarter with the Communication Services sectors at +18.4%, Health Care +16.9%, Information Technology +16.4, Energy +12.4%, Utilities +8.5%, Consumer Discretionary +6.9%, Financials +4.3%, and Real Estate +2.1%. Three sectors are forecast to see an earnings contraction for the quarter with Consumer Staples –0.4%, Industrials –3.4%, and Materials –9.7%.

Revenue growth is forecast across nine of the eleven sectors with Information Technology at +9.5%, Energy +9.0%, Communication Services +7.3%, Real Estate +6.3%, Health Care +5.8%, Utilities +4.6%, Consumer Discretionary +4.4%, Financials +2.7%, and Consumer Staples +2.3%. Revenue for the Industrial sector is forecast to be flat and the Materials sector is expected to see a revenue decline of 2.0%.