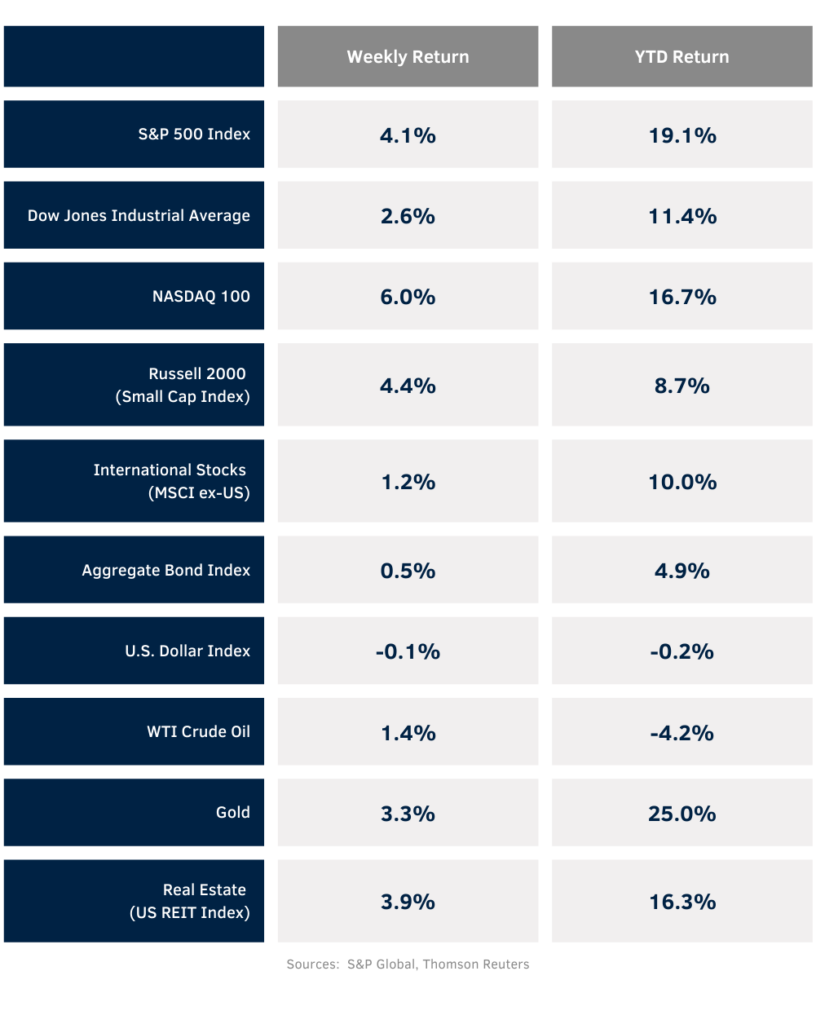

Stocks rallied back last week in anticipation of an easing in monetary policy to be announced this week. For the week, the S&P 500 was +4.1%, the Dow was +2.6%, and the NASDAQ was +6.0%. Within the S&P 500 Index, the Technology, Consumer Discretionary, and Communication Services sectors led the market. The Energy, Financial, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield decreased to 3.659% at Friday’s close versus 3.717% the previous week.

Inflation data for August did not contain any surprises to dissuade investors that the Federal Open Market Committee (FOMC) is still on track to lower interest rates this week. The August Consumer Price Index (CPI) was +0.2% month-over-month and +2.5% year-over-year. Core CPI, which excludes food and energy prices, was +0.3% month-over-month and +3.2% year-over-year. The August Producer Price Index (PPI) was +0.2% month-over-month and +1.7% year-over-year. Core PPI, which excludes food, energy, and trade prices, was +0.3% month-over-month and +3.3% year-over-year. The FOMC is widely expected to begin an easing of monetary policy at its meeting on Wednesday. CME Fed funds futures for September imply a 100% probability of a rate cut with 41% probability for a reduction of 0.25% and 59% probability for a reduction of 0.50%. Between now and year-end, a total of 1.25% in cuts is currently expected versus the current Fed funds range of 5.25% to 5.50%.

We are few weeks away from the start of the third quarter earnings reporting period. Third quarter earnings growth is currently forecast at 4.9% year-over-year with revenue growth of 4.8%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.2% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the CME Fed funds futures.

Financial Market Update

Dissecting Headlines: Back to the Futures

Each week we have been citing the CME Fed funds futures as a data point of investors’ outlook for when and how much the Federal Reserve could eventually lower interest rates. Fed funds futures are financial contracts traded on the Chicago Mercantile Exchange (CME). These monthly contracts are used by banks and bond managers to hedge against changes in short-term interest rates. Speculators also use the contracts to profit on FOMC rate announcements and other economic events that can influence monetary policy such as data on inflation or employment.

The amount of contracts open at various price levels can be used as a probability tool to express the market’s view on where Fed funds will be in the future ranging from one month to sixty months. The September contract, which we mention above, implies there is a 41% probability for a reduction of 0.25% and 59% probability for a reduction of 0.50%. These probabilities can constantly shift as investors absorb economic and market data. The near month contracts show more certainty whereas the farther out contacts are often spread across a greater range of outcomes. The September 2025 contract, for example, has outcomes across nine different levels for Fed funds ranging from a low range of 1.75% – 2.00% to a high range of 3.75% – 4.00%.

One key input to the outlook for Fed funds over the next few months will likely be the FOMC’s Summary of Economic Projections which will be released at the conclusion of the FOMC meeting on Wednesday. The FOMC will layout its collective thinking for key economic data to include Gross Domestic Product (GDP), the unemployment rate, inflation, and most importantly, its outlook for Fed funds for the remainder of the year and into 2025 and 2026.