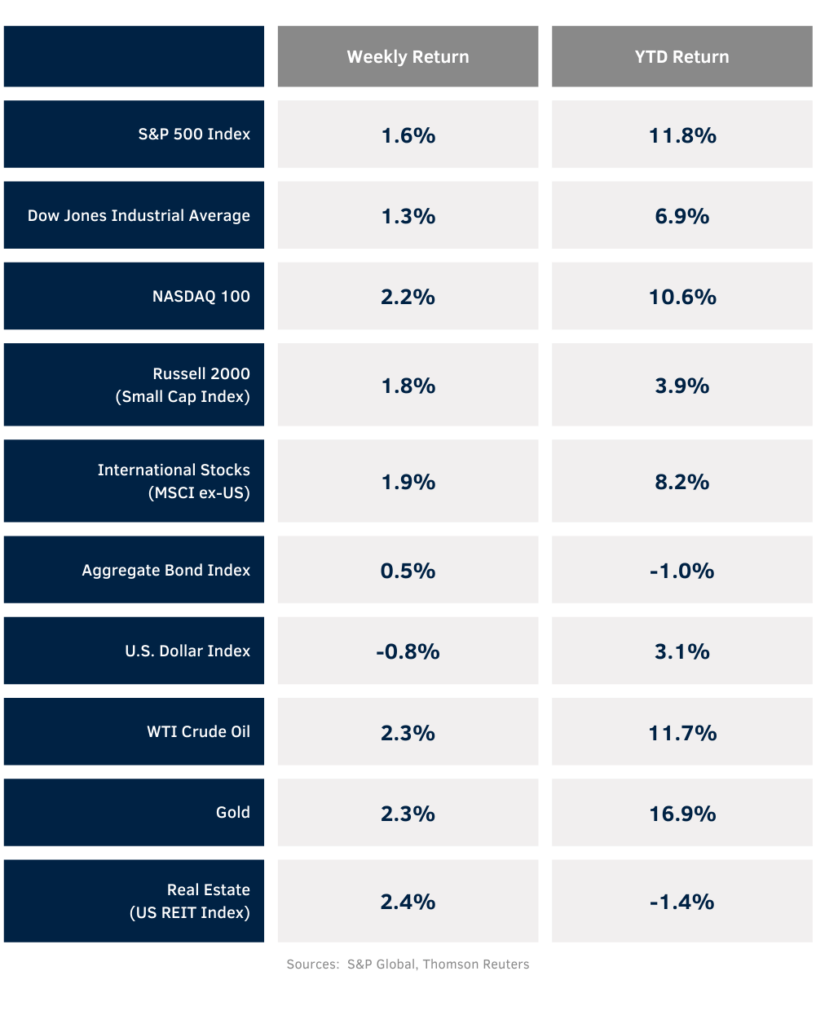

Stocks advanced to new highs last week. For the week, the S&P 500 Index was +1.6%, the Dow was +1.3%, and the NASDAQ was +2.2%. Within the S&P 500 Index, the Technology, Real Estate, and Health Care sectors led the advance, while the Industrial, Consumer Discretionary, and Materials sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.422% at Friday’s close versus 4.494% the previous week.

The April Consumer Price Index (CPI) report showed prices increased 0.3% month-over-month and 3.4% year-over-year. While this remains elevated, investors had a positive reaction to the data as it was lower than the forecast for a 0.4% increase month-over-month. This has kept expectations alive for an initial cut in the Fed funds target rate in September.

We are almost complete with the first quarter earnings reporting season with 93% of companies in the S&P 500 Index having reported results. For the companies that have already reported, 78% have reported a positive earnings surprise and 60% have reported a positive revenue surprise. For the coming week, 17 companies in the S&P 500 Index are scheduled to report earnings. The current first quarter consensus forecast for the S&P 500 Index is 5.7% earnings growth with revenue growth of 4.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.1% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the forecast for Memorial Day travel.

Financial Market Update

Dissecting Headlines: Memorial Day Travel

The summer travel season kicks off with the upcoming Memorial Day Weekend, May 24th to 27th. The American Automobile Association (AAA) forecasts 43.8 million Americans (12.5% to 13.0% of the population) will travel more than 50 miles from their homes during the holiday weekend. This is a 4.1% increase year-over-year and surpasses 2019’s pre-pandemic level of 42.8 million.

Auto travel is the most prevalent, with 38.4 million Americans expected to travel by car, a 4.0% increase year-over-year. National average gasoline prices are 1.6% higher year-over-year at $3.593 per gallon.

Airlines should carry 3.51 million travelers for the holiday weekend, a 4.8% year-over-year increase and 9.3% higher than 2019. Based on the recent Consumer Price Index (CPI) report, airfares are 5.8% lower year-over-year.

Other modes of travel, to include trains and buses, are expected to carry 1.90 million passengers, an increase of 5.6% year-over-year.

Other travel related categories from the CPI show hotel and motel prices are 0.4% lower year-over-year, recreational services are 4.1% higher, and food away from home is 4.1% higher.