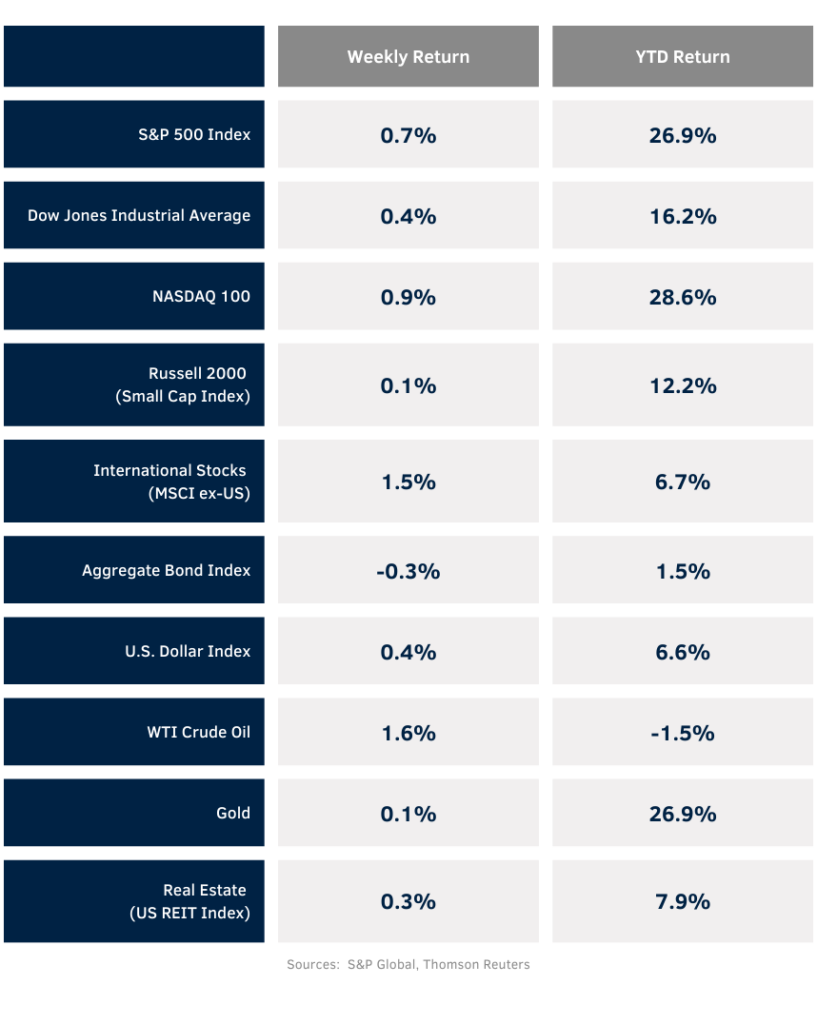

Equities had a modest advance during the holiday shortened week. For the week, the S&P 500 Index was +0.7%, the Dow Jones Industrials +0.4%, and the NASDAQ +0.9%. The S&P 500 Index was led by the Energy, Health Care, and Communication Services sectors, while the Materials, Consumer Staples, and Industrial sectors lagged. The 10-year U.S. Treasury note yield increased to 4.623% at Friday’s close versus 4.530% the previous week.

There has been a lull in both economic and corporate news over the holiday period. The first full week of January gets back to business with the December Employment Situation report on January 10th and a few companies starting the fourth quarter earnings reporting period.

Fourth quarter earnings growth is currently forecast at 11.9% year-over-year with revenue growth of 4.6%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 5.1%. Full-year 2025 earnings are expected to grow by 14.8% with revenue growth of 5.8%.

In our Dissecting Headlines section, we look at investor sentiment heading into the new year.

Financial Market Update

Dissecting Headlines: Investor Sentiment

The American Association of Individual Investors (AAII) weekly sentiment survey shows a good degree of balance heading into the new year. The weekly survey asks investors their thoughts on where the stock market is heading over the next six months.

For the week ending December 25th, 37.8% of investors are Bullish over the next six months, 28% are Neutral, and 34.1% are Bearish. This is close to inline with the survey’s historical average of 37.5% Bullish, 31.5% Neutral, and 31.0% Bearish.

The Bullish level has declined sharply during the month of December. The December 4th survey indicated 48.3% Bullishness. The Bullish peak for the year was 52.7% in the July 17th survey. A year ago, the final survey of 2023 indicated 46.3% Bullish, 28.6% Neutral, and 25.1% Bearish.

The survey can be a contrarian indicator when the sentiment is at positive or negative extremes. The end of 2022 survey, after a year of sharp market decline, was 26.5% Bullish, 25.9% Neutral, and 47.6% Bearish. The market went on to two years of above average gains.

The current survey indicates a healthy balance between optimism and pessimism, so there is a good chance 2025 could be a year of normalized returns for stocks. It takes two sides to make a market.