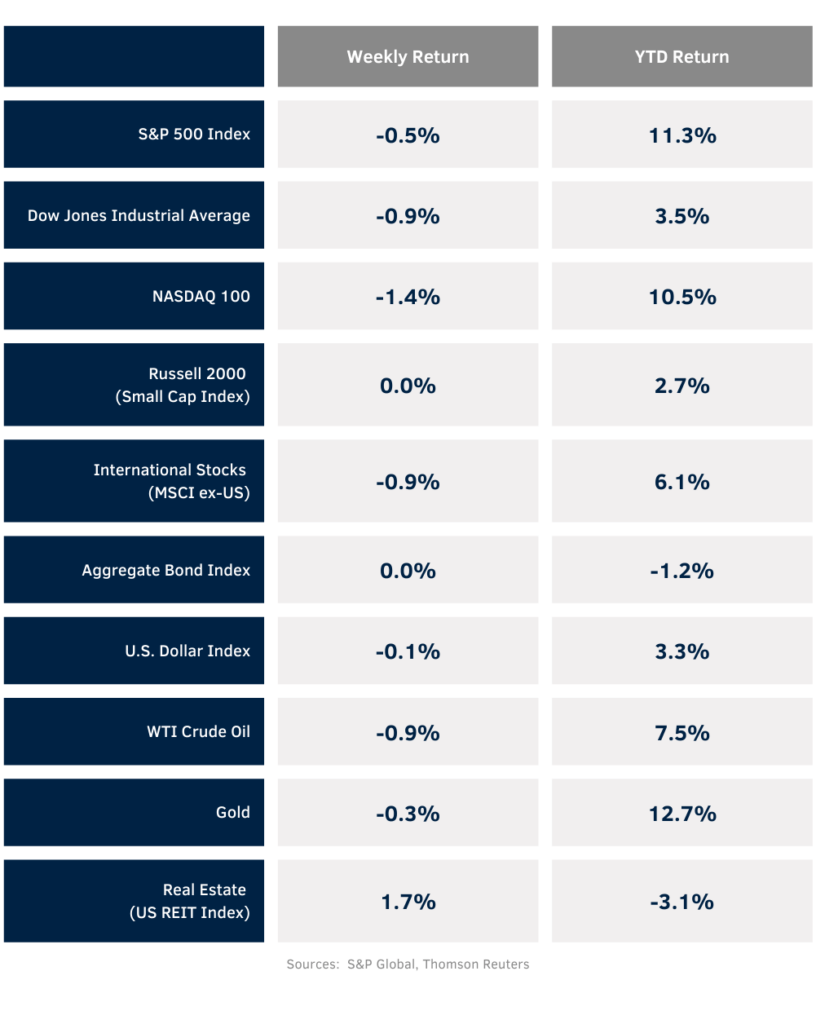

The S&P 500 Index rose 4.96% in May to recover the 4.08% decline from April. For the week, the S&P 500 Index was -0.5%, the Dow was -0.9%, and the NASDAQ was -1.4%. Within the S&P 500 Index, the Energy, Real Estate, and Utility sectors led, while the Technology, Industrial, and Health Care sectors lagged. The 10-year U.S. Treasury note yield increased to 4.486% at Friday’s close versus 4.464% the previous week.

The economic focus this week should be the May Employment Situation Report scheduled for release on Friday. Current CME Fed funds futures show no changes in interest rates are likely for the June and July meetings. The probability for an initial cut in the Fed funds target rate in September is at 53.9%.

With over 98% of companies in the S&P 500 Index complete on first quarter earnings reports, year-over-year earnings growth for the quarter should finish around 5.9% with revenue growth of 4.2%. For the coming week, seven companies in the S&P 500 Index are scheduled to report earnings. Looking ahead to the second quarter, earnings growth is expected to accelerate to 9.2% year-over-year with revenue growth of 4.7%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the Personal Consumption Expenditures (PCE) Price Index and data leading up to the June Federal Open Market Committee (FOMC) meeting.

Financial Market Update

Dissecting Headlines: Updating Data

The Personal Consumption Expenditures (PCE) Price Index is a measure of price changes for consumer goods and services. Like the Consumer Price Index (CPI), it measures prices of goods and services commonly purchased by households. While the CPI often captures the headlines when it is reported, the Federal Reserve focuses on the PCE as its primary gauge for consumer inflation.

The April PCE Price Index, reported last week, was +2.7% year-over-year and the core PCE, which excludes food and energy prices, was +2.8%. Based on the March Summary of Economic Projections, the Federal open Market Committee (FOMC) is targeting the PCE Price Index to get to a +2.4% level by the end of 2024 and core PCE to a +2.6% level. For 2025, the FOMC is forecasting the PCE Price Index at +2.2% versus 2024 and core PCE at +2.2% versus 2024.

The next FOMC meeting is scheduled for June 11th and 12th. Based on data accumulated since the March meeting, the FOMC will issue a new Summary of Economic Projections. While the FOMC is not expected to lower the Fed funds rate at the meeting, the new summary should provide insight to the committee members collective thinking and help gauge the prospects for a reduction in the Fed funds rate between now and year-end.

New York Fed Governor John Williams stated last week that he expects PCE inflation to moderate to 2.5% this year and move closer to 2.0% next year. This is consistent with the FOMC’s March Summary of Economic Projections. While an annualized PCE target of 2.0% is the Fed’s goal, Fed officials have said they could see a reduction in the Fed funds rate when it has gained confidence that inflation is moving sustainably toward the 2% goal. As mentioned above, current CME Fed funds futures are currently pricing in a 0.25% reduction in the Fed funds rate at the September meeting. Persistent inflation has made this initial rate reduction move further out on the calendar several times.

Watching this week’s Employment Report and the May CPI, scheduled for June 12th, should provide the last data before the Fed’s June update.