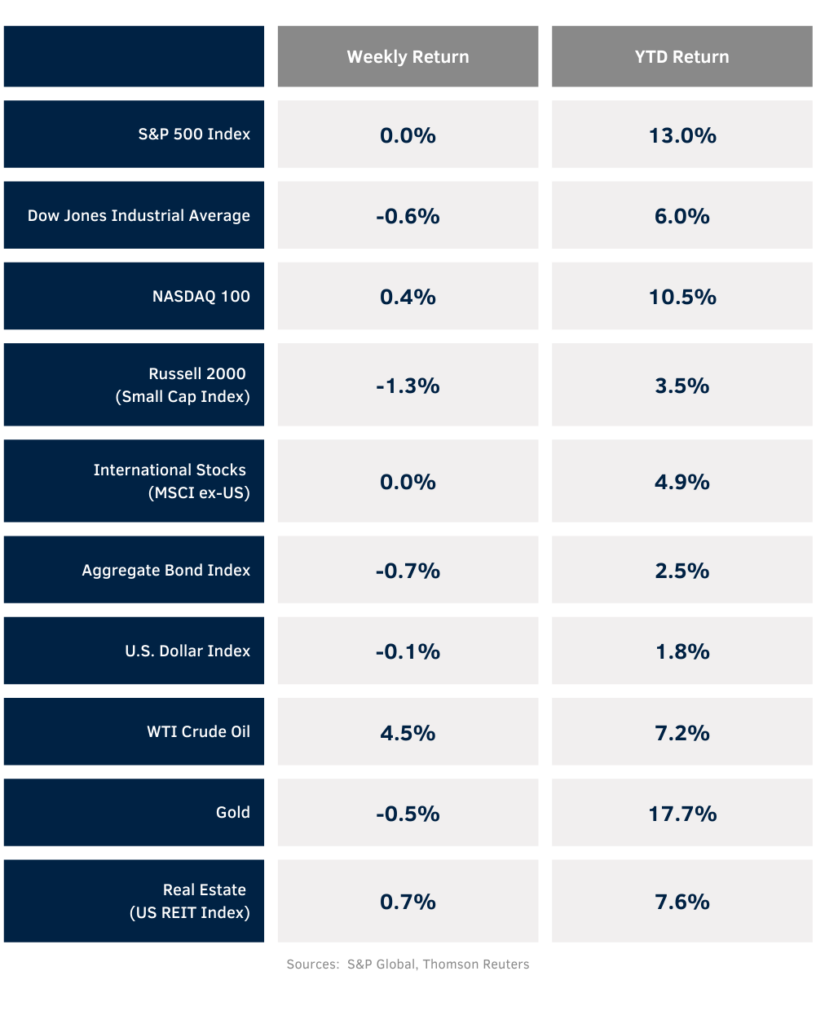

The S&P 500 Index fell sharply last Monday, down 3% on the day, but slowly gained that back over the course of the week to finish near flat. For the week, the S&P 500 was unchanged, the Dow was -0.6%, and the NASDAQ was +0.4%. Within the S&P 500 Index, the Industrial, Energy, and Communication Services sectors led the market, while the Materials, Consumer Discretionary, and Utility sectors lagged. The 10-year U.S. Treasury note yield increased to 3.932% at Friday’s close versus 3.796% the previous week.

The macroeconomic focus shifts back to inflation this week with the July Producer Price Index (PPI) scheduled for release on Tuesday and Consumer Price Index (CPI) on Wednesday. CME Fed funds futures for September imply a 0.25% rate cut versus a 0.50% cut last week. Between now and year-end, a total of 1.00% in cuts is seen versus 1.25% last week.

We are 91% done with second quarter earnings reports. Another nine companies in the S&P 500 Index scheduled to report earnings this week. For the second quarter, earnings growth is expected be 10.8% higher year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.2% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at one catalyst for the sell off last Monday, the yen carry trade.

Financial Market Update

Dissecting Headlines: Carry Trade

The S&P 500 Index closed down 3.0% last Monday. Part of the reason for the selloff was a potential unwinding of the yen carry trade. A carry trade involves borrowing money where interest rates are low and investing them where rates are higher. The yen carry trade borrows in yen and invests in dollars. Up until March of this year, interest rates in Japan were negative and U.S. rates were high due to the Federal Reserve’s fight against inflation.

When the Bank of Japan recently raised interest rates to 0.25% and the Federal Reserve held rates steady at the 5.25% to 5.50% range at the end of July, doubt creeped in that the Federal Reserve was behind the curve in reducing interest rates. This concern elevated after the lower than expected Employment Situation Report for July. Thoughts that the Federal Reserve would need to potentially lower rates before its September meeting triggered some investors to unwind their U.S. dollar positions and repay their borrowed yen. This gained steam and sent enough of a shock through the markets last Monday that both the Japanese and U.S. equity markets declined. Markets steadied themselves over the course of the week.

The global financial system is highly interconnected and money can move rapidly to both chase opportunity and retreat from risk. These unwinding trades can be painful when they are happening, but serve to tamp over-speculation.