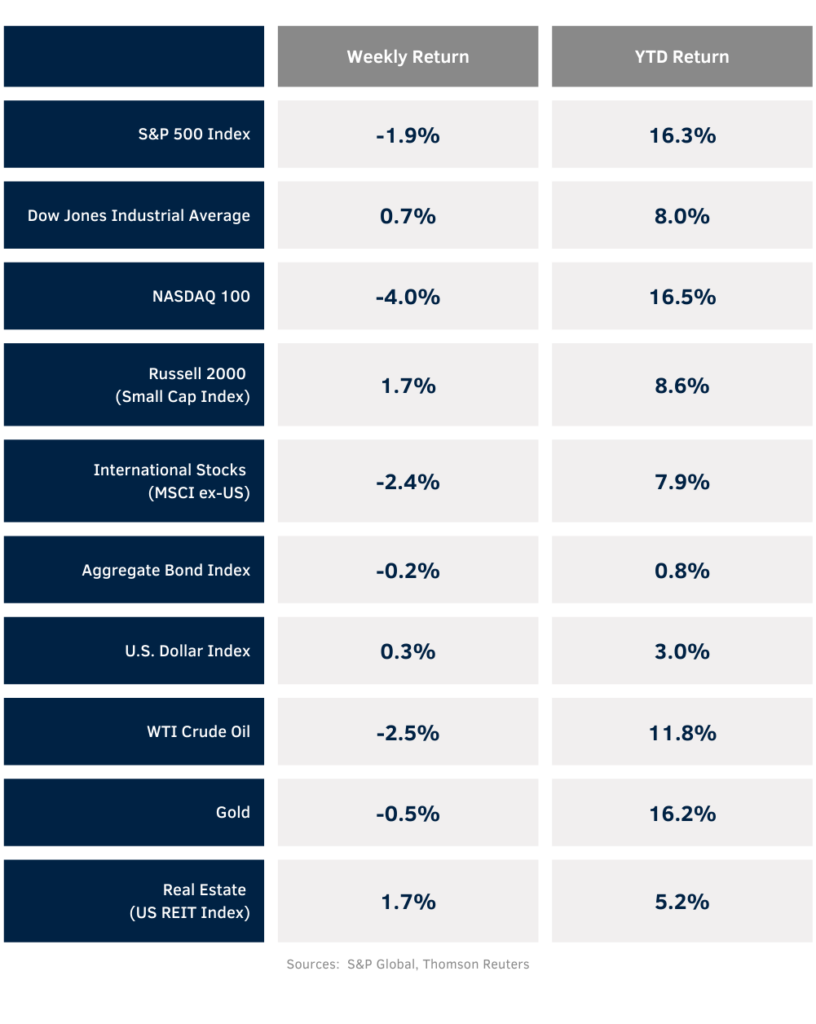

The rotation away from large cap tech stocks and into small cap stocks continued last week. The S&P 500 Index was -1.9%, the Dow was +0.7%, and the NASDAQ was -4.0%. The Russell 2000 Index was +1.7% for the week. Within the S&P 500 Index, the Energy, Financial, and Real Estate sectors led, while the Technology, Communication Services, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield increased to 4.239% at Friday’s close versus 4.225% the previous week.

Investors have a lot to digest this week. A steep ramp up of companies reporting second quarter earnings results, the June PCE Price Index scheduled for Friday, and the political volatility following President Biden’s exit from the 2024 election announced on Sunday.

The next Federal Open Market Committee (FOMC) meeting is scheduled for July 30-31st. CME Fed funds futures show a 95.3% probability that the Fed funds rate stays in its 5.25% to 5.50% range. There is currently a 96.2% probability for an initial 0.25% rate cut at the September meeting.

We are entering the peak weeks of the Second quarter earnings reporting season. There are 138 companies in the S&P 500 Index scheduled to report earnings this week. For the second quarter, earnings growth is expected be 9.7% higher year-over-year with revenue growth of 4.7%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 11.0% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the new uncertainty of the presidential election.

Financial Market Update

Dissecting Headlines: Political Changes

For most of the year, it felt that the 2024 presidential election was the furthest thing from people’s minds. Over the past ten days, that has heated up to major focus. The assassination attempt on Donald Trump, followed by the Republican convention, and Sunday’s withdrawal from the race by President Biden has pushed politics and the elections into investors’ minds.

While some of the shock value of President Biden’s withdrawal has been muted due to the repeated calls for him to stepdown from the race over the past few weeks, it now presents additional uncertainty. The Democratic convention starts on August 19th, so the next few weeks are likely to see speculation on potential Democratic Party candidate combinations. Based on early endorsements from Sunday, Vice President Harris is the only indicated candidate currently. That could change over the next few days.

While we expect the focus of investors to remain on fundamental earnings results, as well as economic data to gauge the direction of monetary policy, the uncertainty injected into the political process is likely to lurk in the background. It is still 105 days until election day and we are likely to see occasional bouts of volatility as attention grabbing headlines related to the election emerge between now and election day. In the long run, the weighing machine should be more important than the voting machine.