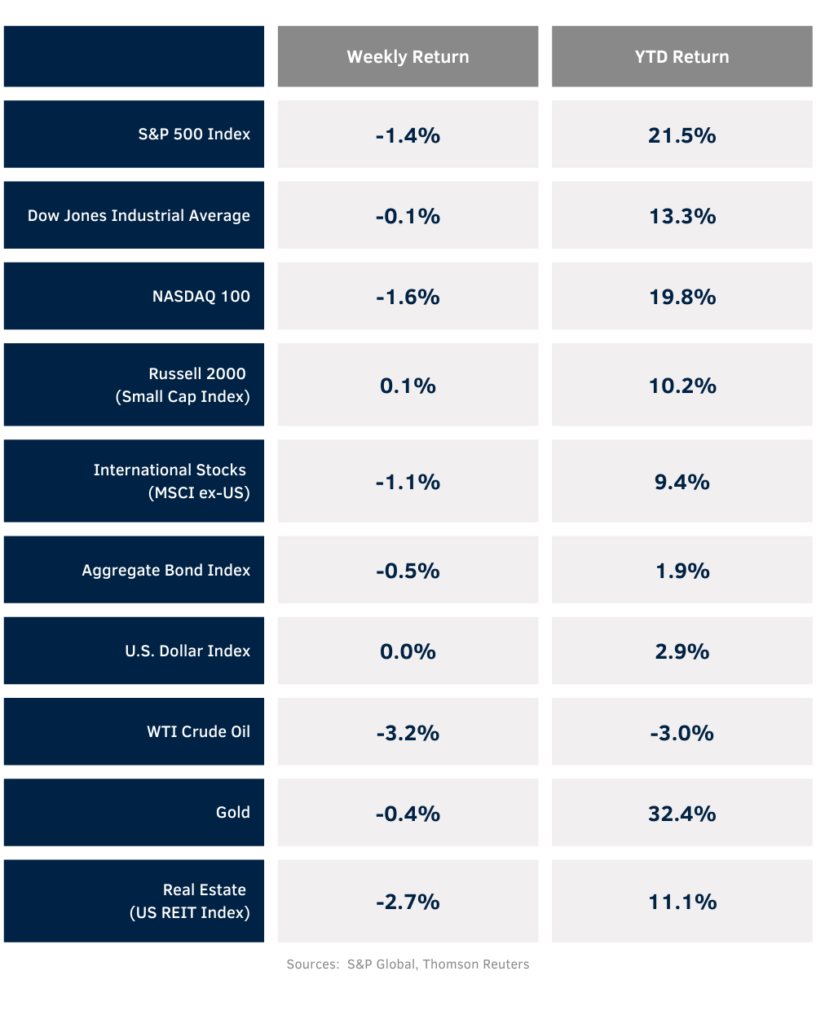

Equity markets declined for a second week. For the week, the S&P 500 was -1.4%, the Dow -0.1%, and the NASDAQ -1.6%. Within the S&P 500 Index, the Communication Services and Consumer Discretionary sectors posted the only two weekly advances, while the Technology, Real Estate and Utility sectors saw the greatest declines. The 10-year U.S. Treasury note yield increased to 4.375% at Friday’s close versus 4.239% the previous week.

The most impactful week of the year may be upon us with the one-two punch of both the election and the November Federal Open Market Committee (FOMC) meeting. Polls and predictive betting markets show the election as a toss-up for the presidency and multiple senate races. Speculation remains whether definitive results will be known by Tuesday night. Regardless of the election results, the FOMC is widely expected to lower the Fed funds rate by 0.25% at the conclusion of its meeting on Thursday.

The pending FOMC decision comes off a week of mixed economic data. The preliminary third quarter GDP showed the economy grew at a 2.8% rate. Inflation in September, as measured by Personal Consumption Expenditures (PCE) Prices, was 2.1% higher year-over-year and core prices were 2.7% higher. Lastly, the October Employment Situation Report showed only 12,000 net new jobs created during the month.

We are 70% of the way through the third quarter earnings reporting period. Reports continues this week with 103 companies in the S&P 500 Index scheduled to release results. Third quarter earnings growth is currently forecast at 5.1% year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the latest changes announced for the Dow Jones Industrial Average.

Financial Market Update

Dissecting Headlines: Keeping Up with the Dow Joneses

Keeping up with the times, the Dow Jones Industrial Average (DJIA) has announced its two latest changes to the 30-stock index. Intel is being replaced by fellow technology company Nvidia and Dow (no relation) is being replaced by fellow chemical company Sherwin-Williams.

The DJIA has been around since 1896 and is considered the short-list of blue chip stocks in the U.S. economy. It makes periodic changes to best reflect the economy. The senior member of the index is Procter & Gamble, added in 1932, but the next senior member is 3M, added in 1976. Prior to the currently announced changes, the most recent change was Amazon replacing Walgreens Boots Alliance earlier this year. The last multi-stock shuffle occurred in 2020 when Salesforce replaced Exxon Mobil, Amgen replaced Pfizer, and Honeywell replaced Raytheon.

Some critics deem the DJIA too narrow to represent the economy with only 30 stocks. Indeed, all 30 DJIA stocks are also included in the S&P 500 Index which is generally considered the most representative stock index of the U.S. economy. Still, the DJIA has some cache because of its large numeric value at around 42,000. It is exciting for television commentators to say that the DJIA rose or fell 100 points on a given day, even though that is only a 0.25% change. Saying the S&P 500 rose or fell 14 points just doesn’t sound the same.

As seen above, we cite the S&P 500 Index and NASDAQ, along with small capitalization, international, and other indices as multiple gauges to measure the overall global economy and investment landscape.