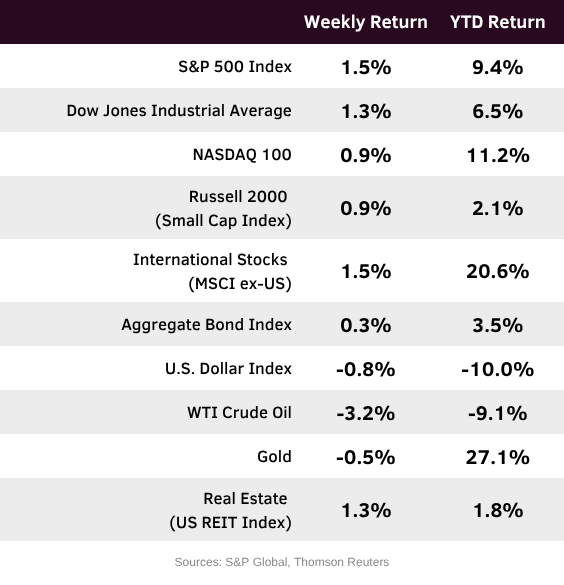

Stocks remained near all-time highs, buoyed by a trade deal announcement with Japan. For the week, the S&P 500 Index was +1.5%, the Dow Jones Industrials +1.3%, and the NASDAQ +0.9%. The Health Care, Materials, and Industrial sectors led the S&P 500 Index for the week, while the Consumer Staples, Technology, and Utility sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.383% at Friday’s close versus 4.427% the previous week.

Ahead of the August 1st tariff deadline, Japan agreed to a trade deal with the United States. This was followed by an agreement with the European Union announced over the weekend. The U.S.’s three largest trading partners, Canada, Mexico, and China, have yet to finalize trade agreements.

The Federal Reserve is expected to hold interest rates steady at its meeting on Wednesday. Key economic data is scheduled for later in the week with the June Personal Consumption Expenditures (PCE) Price Index on Thursday and the July Employment Situation report on Friday. CME Fed funds futures forecast 0.25% rate cuts at the September and December meetings.

We are hitting the midpoint of second quarter earnings reporting period. This week, 164 companies in the S&P 500 Index are scheduled to report earnings. Of the 34% of companies that have reported so far, 80% have reported upside results versus consensus expectations. This has increased S&P 500 Index earnings growth expectations for the quarter to 6.4% from 4.8% at the start of the reporting period, and revenue growth to 5.0% from 4.2%. Full-year 2025 earnings are expected to grow by 9.6% with revenue growth of 5.3%.

In our Dissecting Headlines section, we look at the current trade and tariff landscape.

Financial Market Update

Dissecting Headlines: Trade and Tariff Update

Last week, Japan signed a trade agreement with the U.S. and the European Union (EU) announced an agreement over the weekend. Japan accounts for approximately 4.3% of total trade with the U.S. and the EU accounts for approximately 18.3%, with the largest partners being Germany and the Netherlands.

The Japan agreement includes a tariff reduction to 15% from 25%, increased U.S. export access to Japan, and a commitment for Japan to invest $550 billion in the United States. The $550 billion in investments is targeted toward energy infrastructure, semiconductor manufacturing, critical minerals, pharmaceuticals, and shipbuilding.

The EU agreement includes a 15% tariff on most EU goods with a zero tariff on some strategic goods. The EU has committed to purchasing $750 billion of energy from the U.S., mainly liquified natural gas and crude oil, and invest $600 billion in the United States. The strategic goods with zero tariff include aircraft and parts, certain chemicals and pharmaceuticals, semiconductor equipment, and selected agricultural products and natural resources. The $600 billion in investments is targeted toward energy infrastructure, advanced manufacturing, defense and aerospace, and critical minerals.

The August 1st tariff deadline arrives this week. The U.S.’s top three trading partners, Canada, Mexico, and China have yet to reach agreements. Other major partners still working on agreements include South Korea, India, and Brazil.