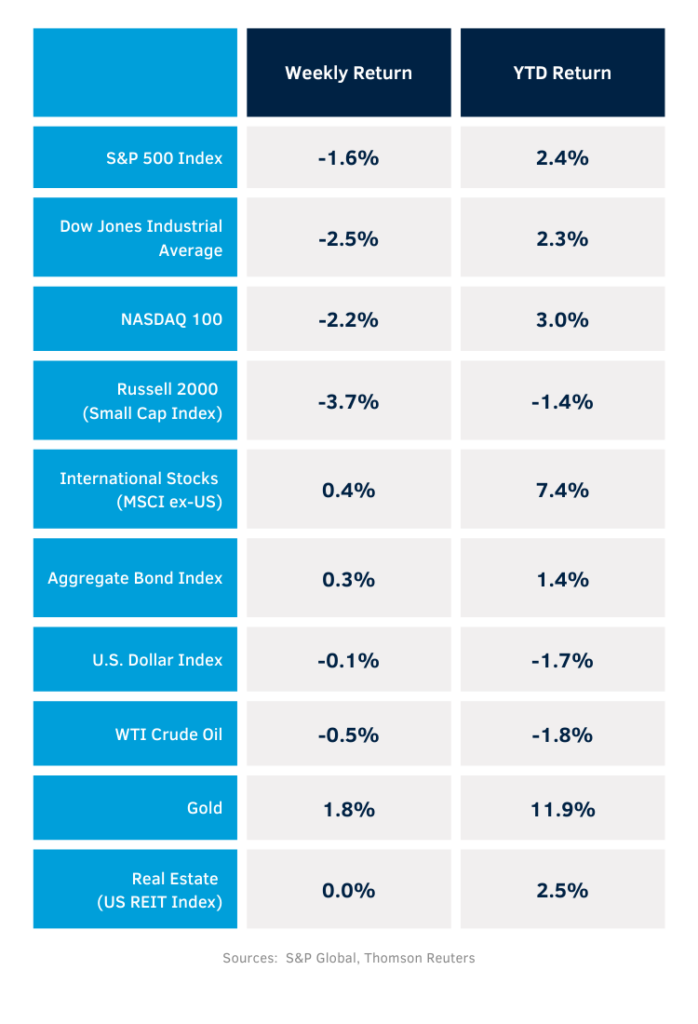

The S&P 500 Index experienced both a new all-time high and its worst down day of the year last week. For the week, the S&P 500 Index was -1.6%, the Dow Jones Industrials -2.5%, and the NASDAQ -2.2%. The S&P 500 Index was led by the Utility, Health Care, and Energy sectors, while the Consumer Discretionary, Communication Services, and Industrial sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.425% at Friday’s close versus 4.476% the previous week.

Further progress on inflation is a key metric for the Federal Reserve to consider continuing monetary policy easing. This week we should see January Personal Consumption Expenditures (PCE) Price Index data. The PCE is the Fed’s preferred inflation gauge, so the report should carry some weight toward the Fed’s outlook. As of now, the Fed looks to be on hold at its March Federal Open Market Committee (FOMC) meeting with no rate cuts seen until at least the June meeting. We think the Fed’s outlook will also be clearer once fiscal policy is firmly set by Congress and the Trump administration with the passing of a budget in late March or early April.

The fourth quarter earnings reporting period is almost complete with 435 of 500 companies already reported. This coming week, another 57 companies are scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 15.9% year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.4% with revenue growth of 5.2%. Full-year 2025 earnings are expected to grow by 11.1% with revenue growth of 5.3%.

In our Dissecting Headlines section, we look at where the U.S. Government makes and spends money.

Dissecting Headlines: Where the Money Goes

With proposals and debates underway on the budget package to bring the Trump administration’s fiscal policy into practice, we wanted to look at where the U.S. government current makes and spends money. For FY24 (Oct 24), the U.S. government had revenue of $4.92 trillion and spent $6.75 trillion. The led to a deficit of $1.83 trillion. The FY24 budget deficit was the third largest in history behind the FY20 and FY21 deficits due to the pandemic.

The major categories of income were Individual Income Taxes at $2.43 trillion, Social Insurance and Retirement Contributions at $1.71 trillion, Corporate Income Taxes at $530 billion, Excise Taxes at $101 billion, Customs Duties at $77 billion, Estate and Gift taxes at $32 billion, and other miscellaneous income at $43 billion.

The major categories of spending were Social Security at $1.46 trillion, Health Care at $912billion, Net Interest at $882 billion, Medicare at $874 billion, National Defense at $874 billion, Income Security at $671 billion, Veterans Benefits and Services at $325 billion, Education at $305 billion, Transportation at $137 billion, and Other expenses at $311 billion.

The gross interest payments on government debt were $1.13 trillion and netted down against interest the government received. This has caused concern as the net cost of the national debt exceeds the defense budget. The budget deficits and higher interest rates have increased the cost of the debt burden. The average interest rate on the national debt in FY24 was 3.324% versus 2.970% in FY23 and 2.070% in FY22.

Decisions on the budget, taxes, and government spending will have a significant impact on the economy and Federal Reserve monetary policy in the months ahead.