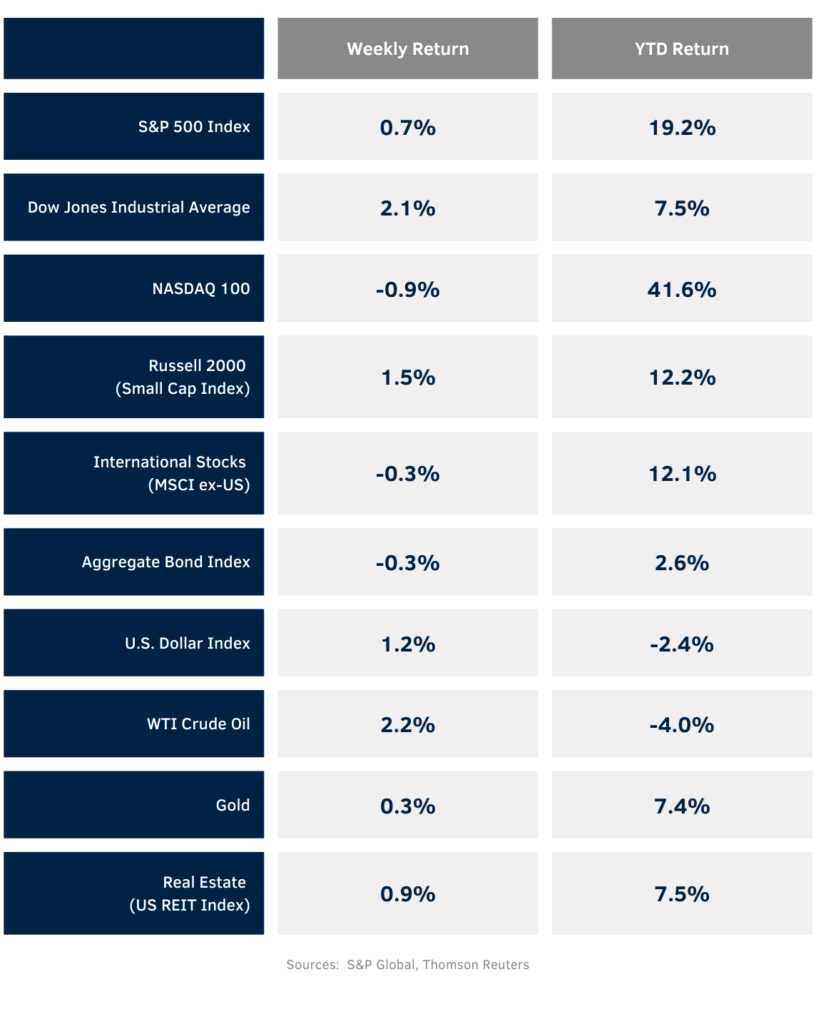

A broadening of industry participants in the market advance helped the S&P 500 Index rise as the tech-heavy NASDAQ 100 fell this past week. The Energy, Healthcare, and Financial Sectors led the market. The weekly return for the S&P 500 Index was +0.7%, the Dow was +2.1%, and the NASDAQ was -0.9%. The 10-year U.S. Treasury note yield increased modestly to 3.839% at Friday’s close versus 3.820% the previous week.

The Federal Open Market Committee (FOMC) meets this week and is widely expected to raise the Fed funds rate by 0.25% on Wednesday afternoon to a 5.25% to 5.50% target range. Current probability for this 0.25% increase in the Fed funds rate on Wednesday is 99.8% versus 98.0% a week ago. After this likely increase, probabilities start to split if there will be a second 0.25% increase before year-end. Based on CME Fed funds futures, the probabilities of Fed funds staying in the 5.25% to 5.50% range for the September, November, and December meetings are 83.9%, 68.2%, and 61.2% respectively.

Earnings reporting picks up steam this week with 173 companies in the S&P 500 Index scheduled to report earnings. Of the 89 companies in the S&P 500 that have reported earnings, 73.0% have reported earnings above analyst estimates. This compares to a long-term average of 66.4% and prior four quarter average of 73.4%. Second quarter earnings expectation for the S&P 500 Index is a 7.9% year-over-year earnings decline on a revenue decline of 0.8%. Current consensus for full year 2023 earnings is an increase of 0.4% on revenue growth of 1.6%.

In our Dissecting Headlines section, we look at current investor sentiment in the American Association of Individual Investors survey.

Financial Market

Dissecting Headlines: Investor Sentiment

The American Association of Individual Investors (AAII) survey asks for investors’ weekly opinions of where the stock market will be (up or down) in the next six month. The current data for the start of the second half of the year indicates that 51.4% of survey respondents are bullish and 21.5% are bearish. This is a huge change since the start of this year when bullish sentiment was 26.5% and bearish sentiment was 47.6%. The AAII survey is often seen as a contrarian indicator, so overly bullish or bearish sentiment is worth noting. The contrarian nature of the survey showed itself in the first half of 2023.

The current 51.4% bullish sentiment is 1.4 standard deviations above its 37.5% historical mean. The historical six-month S&P 500 Index return when sentiment is at this level is 1.4%. The current 26.5% bearish sentiment is 1.0 standard deviation below its 31.0% historical mean. The historical six-month S&P 500 Index return when sentiment is at this level is 5.2%. The two indicators together, if the historical correlation holds, means that modest returns are possible for the remainder of the year.