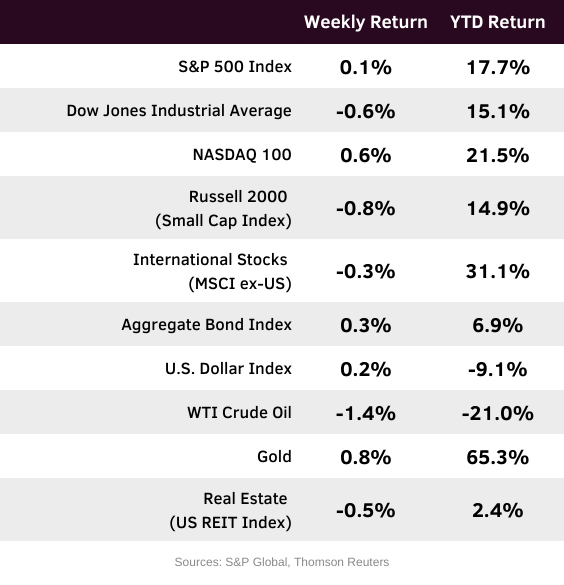

Stocks finished mixed again last week. The S&P 500 Index was +0.1%, the Dow Jones Industrials -0.6%, and the NASDAQ +0.6%. The Consumer Discretionary, Materials, and Health Care sectors led the S&P 500 Index for the week, while the Energy, Real Estate, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield was 4.151% at Friday’s close versus 4.192% the previous week.

The November Consumer Price Index (CPI) was reported with prices +0.2% for the two-month span between September and November and +2.7% year-over-year. Core CPI, which excludes food and energy prices, was +0.2% over the two-month period and +2.6% year-over-year. CME Fed funds futures are currently forecasting a 0.25% reduction in the Fed funds rate at its March meeting.

The government is still catching up on economic data releases. The initial estimate for third quarter Gross Domestic Product (GDP) is scheduled for Tuesday.

As the year winds down, there are no companies in the S&P 500 Index scheduled to report earnings this week. For the fourth quarter, S&P 500 Index earnings are expected to grow by 8.3% with revenue growth of 7.6%. Full-year 2025 earnings are expected to grow by 12.3% with revenue growth of 7.0%.

In our Dissecting Headlines section, we look at the prospects for a Santa Claus Rally.

Financial Market Update

Dissecting Headlines: Santa Claus Rally

As we approach the end of the year, investors often wonder if the stock market will have a Santa Claus Rally. Based on historical returns, the probability is good. Whether it is optimism surrounding the U.S. economy, institutional positioning ahead of the new year, or just the holiday spirit, the impact has been a positive one over the years.

According to the Stock Trader’s Almanac, the Santa Claus Rally period measures the five final trading days of the year and the first two trading days of January. For this year, that would be December 24th to January 5th. Since 1950, the S&P 500 Index has recorded a positive return on 59 occasions, or 79% of the time, during the year-end period. The average increase over those seven trading days has been +1.3%.

The past two years 2023 and 2024 did not experience a Santa Claus Rally with the measurement period down 0.9% in 2023 and down 0.5% in 2024. Since the event has been tracked, there has not been three consecutive years without a Santa Claus Rally.

With the S&P 500 Index up over 17% year-to-date, some could also argue that the entire year has been a gift, and an extra one-percent return at the end of the year would merely be a stocking stuffer.