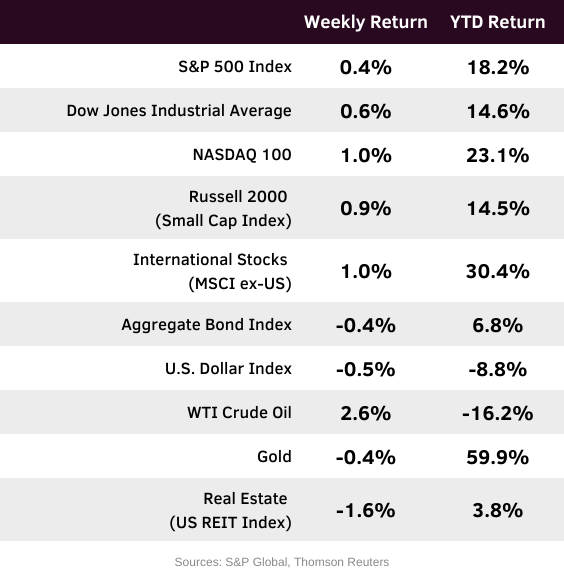

Confidence in an interest rate cut by the Federal Reserve at its meeting this week continued to carry stocks. The S&P 500 Index finished last week +0.4%, the Dow Jones Industrials +0.6%, and the NASDAQ +1.0%. The Energy, Technology, and Consumer Discretionary sectors led the S&P 500 Index, while the Utility, Health Care, and Real Estate sectors lagged. The 10-year U.S. Treasury note yield was 4.139% at Friday’s close versus 4.019% the previous week.

The key event this week is the Federal Reserve’s interest rate policy decision on Wednesday afternoon. CME Fed funds futures are currently showing an 89.6% probability for a 0.25% reduction in the Fed funds target rate to a 3.50% to 3.75% range. In addition to a policy decision on interest rates at the meeting, Fed officials need to publish the quarterly Summary of Economic Projections, giving us a look into potential policy moves for 2026. We may see a wider variance in opinions among Fed policymakers for 2026 as strong concerns exist by some members about inflation while others are concerned about labor market weakness.

We are at the transition period for the earnings reporting cycles. This week has five companies in the S&P 500 Index scheduled to report third quarter results and four companies starting the fourth quarter reporting period. The final tally for the third quarter should see earnings growth of 13.5% with revenue growth of 8.4%. For the fourth quarter, S&P 500 Index earnings are expected to grow by 7.7% with revenue growth of 7.5%. Full-year 2025 earnings are expected to grow by 11.9% with revenue growth of 6.9%.

In our Dissecting Headlines section, we update the progress on Holiday Shopping.

Financial Market Update

Dissecting Headlines: Holiday Shopping Update

If you were shopping either at the store or online between Thanksgiving and Cyber Monday, you were not alone. The National Retail Federation said the Thanksgiving holiday weekend drew a record 202.9 million shoppers. This is 3% higher than last year and higher than the previous record of 200.4 million from 2023. The total also exceeds NRF’s initial expectations of 186.9 million. Adobe Analytics measured spending over the period at $44.2 billion, +7.7% year-over-year, and higher than its estimate of $43.7 billion.

Consumers turned out both in-store and online throughout the extended holiday weekend. A total of 129.5 million consumers shopped in-store, up 3% from last year and online saw 134.9 million shoppers, up 9%. Black Friday remained the top shopping day for both in-store and online, attracting 80.3 million in-store shoppers and 85.7 million online shoppers, slightly below last year’s totals of 81.7 million and 87.3 million. Cyber Monday was the second most popular day for online shopping, attracting 75.9 million online shoppers, +17.9% year-over-year.

In an interesting fusion of online and in-person commerce, Walmart said 10 million shoppers used the Walmart app in stores to discover available items, navigate aisles, compare prices, and check shopping lists they designed prior to coming to the store.

Overall, shoppers spent $337.86 on average on items like gifts, holiday apparel, decorations and other seasonal purchases. This is 7.1% higher than last year’s average of $315.56 and is the highest figure since 2019’s record of $361.90.