Stocks posted a positive return on 2026’s first trading day, but a negative return for the week. Last week, the S&P 500 Index was -1.0%, the Dow Jones Industrials -0.7%, and the NASDAQ -1.7%. The Energy, Utilities, and Industrial sectors all had positive returns and led the S&P 500 Index for the week, while the Consumer Discretionary, Technology, and Financial sectors lagged. The 10-year U.S. Treasury note yield was 4.190% at Friday’s close versus 4.129% the previous week.

Geopolitical events in Venezuela, and possibly Iran, likely dominate headlines early in the week. This could cause some speculation and volatility around commodities like crude oil and gold, as well as energy sector companies that could participate in a potential rebuilding of Venezuelan oil infrastructure.

We start to return to normalcy in economic data with the December Employment Report set for release this Friday. For the first half of 2026, CME Fed funds futures are currently forecasting a single 0.25% reduction in the Fed funds rate at its March meeting.

Fourth quarter earnings for the S&P 500 Index earnings are expected to grow by 8.3% with revenue growth of 7.6%. Full-year 2025 earnings are expected to grow by 12.3% with revenue growth of 7.0%. Looking ahead, current expectations for 2026 full-year earnings are 15.0% with revenue growth of 7.2%.

In our Dissecting Headlines section, we look at where markets stand at the start of 2026.

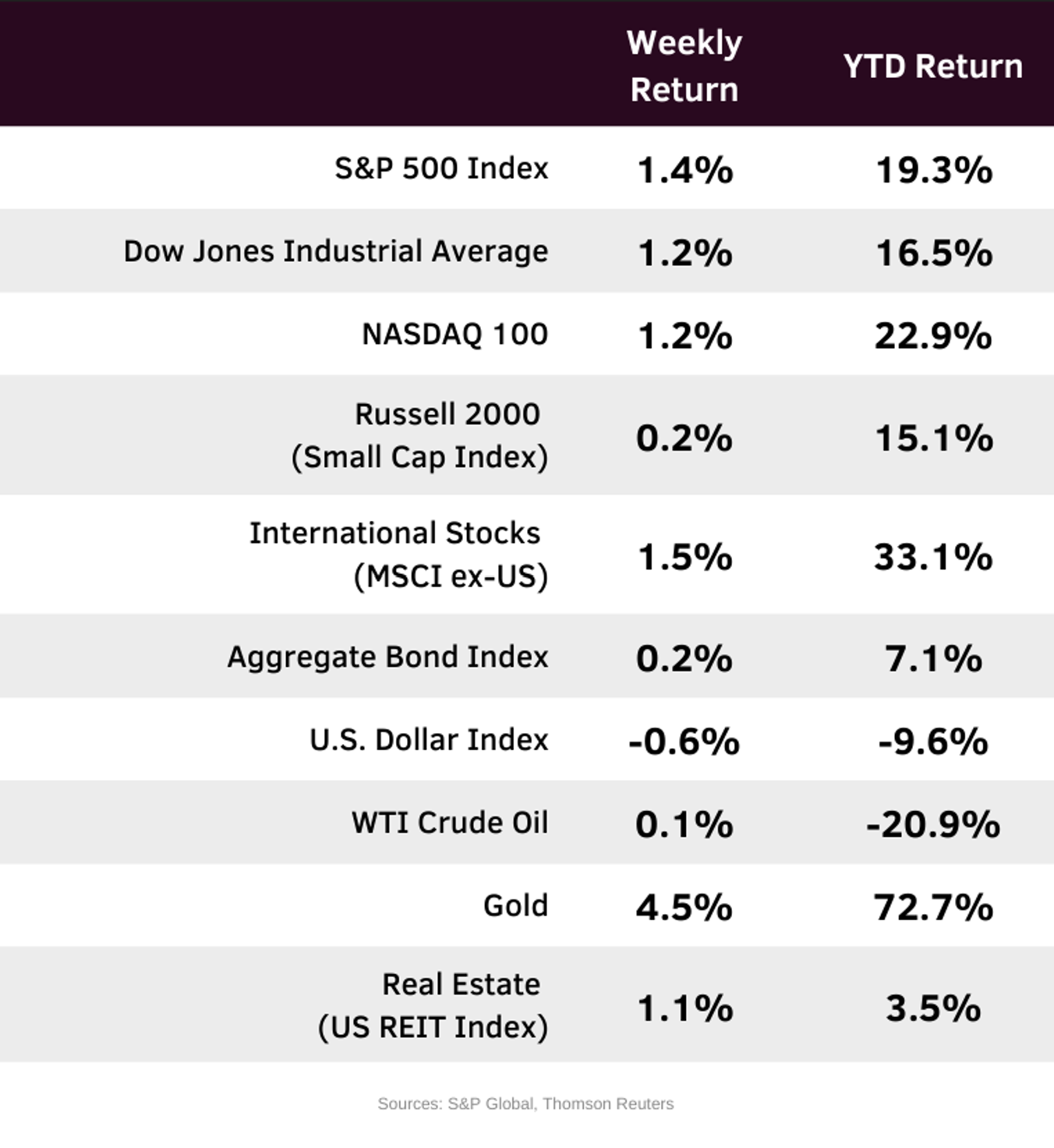

Financial Market Update

Dissecting Headlines: Headwinds and Tailwinds

We enter 2026 with equity markets coming off a third consecutive year of double-digit returns. As always, there are multiple headwinds and tailwinds that can impact performance over the next few months as well as full-year 2026.

Earnings growth should be a tailwind with the current forecast for S&P 500 Index growth at 15.0%. This earnings growth needs to be viewed off an economic background that includes both a weakening labor market, a headwind, and declining pace of inflation, a tailwind. Importantly, consumer spending is a key piece of U.S. economic growth. As we mentioned last week, the retroactive impact of the One Big Beautiful Bill mans that income tax refunds in the first half of the year are likely to be larger than normal and tax withholdings during 2026 are likely to be smaller. This could boost consumer spending, a tailwind, but potentially test a reacceleration of inflation, a headwind.

Current Federal Reserve seems supportive to growth. The cumulative 0.75% reduction in the Fed funds target rate during 2025 was welcome and an additional 0.25% reduction is currently seen for the first half of 2025, a tailwind. Additional policy decisions are likely to hinge on the progress of the economy over the first half of the year.

With 2026 being a mid-term election year, there will likely be elevated rhetoric around every domestic and international initiative by the Trump administration. Policy wins, especially on the economy, would be a tailwind. Geopolitical wrangling whether the recent Venezuela event or continued trade negotiations and tariffs could also add pluses and minuses to investor sentiment.

Despite the always present combination of headwinds and tailwinds, it probabilistically pays to be an optimist. Over the past 100 years (1926 to 2025) the S&P 500 Index has produced a positive return 74% of the time.