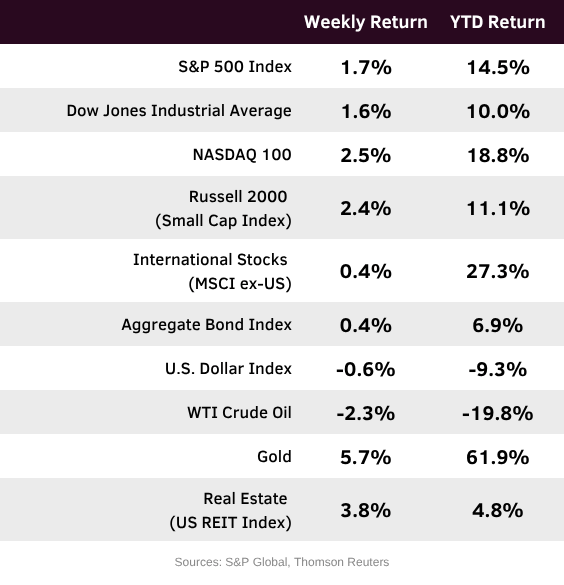

A continued U.S. government shutdown kept investors in the dark on economic data last week and potential weakness in some areas of the credit market raised the concern over potential contagion. Still, for the week, the S&P 500 Index was +1.7%, the Dow Jones Industrials +1.6%, and the NASDAQ +2.5%. The Communication Services, Real Estate, and Technology sectors led the S&P 500 Index for the week, while the Financials, Health Care, and Energy sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.001% at Friday’s close versus 4.055% the previous week.

The September CPI and PPI reports scheduled for last week were delayed. The CPI report is now scheduled for release on Friday. There is no date set for the PPI report. The CPI will be one of the few data points investors will see ahead of the October 29th Federal Reserve policy meeting. The Federal Reserve is widely expected to reduce the Fed funds target rate by 0.25% at the meeting. CME Fed funds futures are also projecting additional cuts in December and January.

Some credit fears leaked into the market last week. Investment bank Jefferies had high lending exposure to First Brands Group, which declared bankruptcy. Regional bank Zions Bancorp announced some credit charge offs and Western Alliance Bancorp announced it was suing a borrower for fraud. These multiple headlines around credit brought concerns about contagion, especially with the rise in private credit funds over the past few years.

The pace of quarterly earnings reports increases this week with 90 companies in the S&P 500 Index scheduled to report results. Third quarter S&P 500 Index earnings growth is forecast at 8.5% with revenue growth of 6.6%. Full-year 2025 earnings are expected to grow by 11.0% with revenue growth of 6.2%.

In our Dissecting Headlines section, we look at recent changes in investor sentiment.

Financial Market Update

Dissecting Headlines: Investor Sentiment

Investors typically hate uncertainty and investor sentiment can be a mirror of the uncertainty in the market and the economy. As the U.S. government shutdown heads into its fourth week with no definitive end in sight, we can see the level of restlessness reflected in investor sentiment data.

The American Association of Individual Investors (AAII) survey asks for investors’ weekly opinions of where the stock market will be (up or down) in the next six month. The current week data showed a drop in Bullish sentiment (those who think the stock market will rise over the next six months) to 33.7% from 45.9% the prior week. This is now below the historical average of 37.5%. The level of Bearish sentiment (those who think the stock market will fall over the next six months) rose to 46.1% from 35.6%. This is well above the historical average of 31.0%.

While this is a significant weekly shift in sentiment, it not the worst we have seen even this year. During the March-April timeframe, when tariff fears were swirling, Bullish sentiment fell as low as 19.1% and Bearish sentiment rose as high as 61.9%. As often happens, those extreme levels proved to be a contrarian buying opportunity.