December 18, 2023

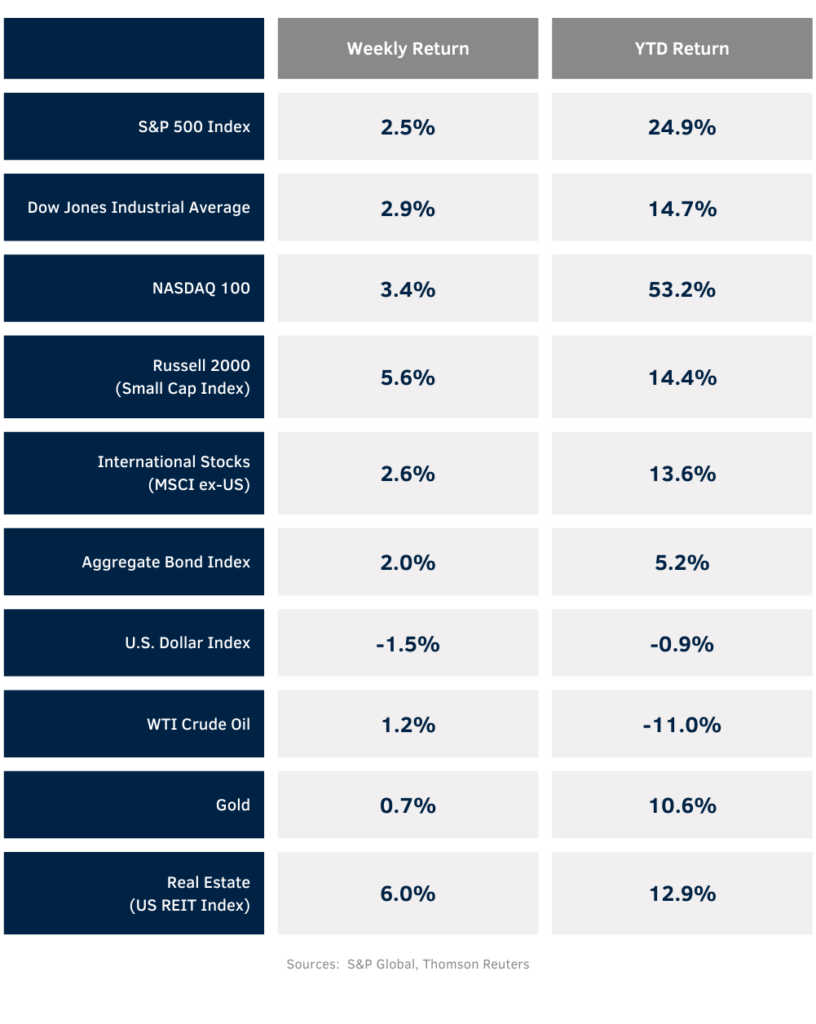

Equities rallied and bond yields declined as the Federal Reserve projected a decrease in the Fed funds rate for 2024 as the pace of inflation is declining. The weekly return for the S&P 500 Index was +2.5%, the Dow was +2.9%, and the NASDAQ was +3.4%. The S&P 500 Index was led by the Real Estate, Materials, and Industrials sectors. The Utility and Communication Services sectors lagged. The 10-year U.S. Treasury note yield decreased to 3.928% at Friday’s close versus 4.245% the previous week.

The Federal Open Market Committee (FOMC) held the Fed funds rate steady at its 5.25% to 5.50% target range at its December meeting and projected that the short-term interest rate could decline by 0.75% in 2024. This was widely seen as confirming evidence the FOMC was done raising rates for this cycle. While the “higher for longer” posture is still in place, current CME Fed funds futures anticipate an initial reduction in the Fed funds rate as early as March 2024.

The S&P 500 Index finished the third quarter earnings reporting period with 7.2% year-over-year earnings growth and revenue growth of 1.7%. This is a substantial increase from the 1.6% earnings and 0.8% revenue growth forecasted at the start of the earnings reporting period. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.5% on revenue growth of 2.0%. Looking ahead, current consensus for full-year 2024 is 11.4% earnings growth on 5.1% revenue growth.

In our Dissecting Headlines section, we look at the changes in the FOMC’s Summary of Economic Projections from last week’s meeting.

Financial Market Update

Dissecting Headlines: FOMC Projections

The FOMC left the Fed funds target rate at its current 5.25% to 5.50% target range. The significant change was made in its quarterly Summary of Economic Projections where it changed its 2024 projection for the Fed funds target rate to 4.50% to 4.75% versus its previous projection of 5.00% to 5.525% that it published at the September meeting.

Most of the other underlying assumptions for 2024 were little changed from the September meeting. 2024 Gross Domestic Product (GDP) is currently forecast at 1.4% growth versus 1.5% in September and the unemployment rate projection was held consistent at 4.1%. The projections for inflation measured by Personal Consumption Expenditures (PCE) prices of 2.4% and core inflation, which exclude food and energy prices, of 2.4% were also little changed versus 2.5% and 2.6% from the September meeting.

The changes in the Fed funds rate projection was enough to give investors confidence the FOMC was complete with the current monetary policy tightening cycle. While we know the direction the Fed funds rate is likely to take, speculation remains around timing. The FOMC is likely to remain diligent against a re-acceleration of inflation. This could cause some market volatility in early 2024 until the timing of interest rate declines becomes clearer.