Equity markets rallied Friday on December rate cut optimism but closed lower for the week. The S&P 500 Index finished the week -1.9%, the Dow Jones Industrials -1.8%, and the NASDAQ -3.0%. The Communication Services, Health Care, and Consumer Staples sectors led the S&P 500 Index, while the Technology, Consumer Discretionary, and Energy sectors lagged. The 10-year U.S. Treasury note yield was 4.063% at Friday’s close versus 4.147% the previous week.

The September Employment Situation report showed 119,000 net new jobs created versus an expectation of 50,000. July and August jobs were revised lower by a total of 33,000. The September unemployment rate rose to 4.4% versus 4.3% in August.

Odds shifted for a December rate cut on Friday after New York Fed President John Williams expressed that current policy is still modestly restrictive and there is room for another near-term cut without jeopardizing the 2% inflation target. This moved CME Fed funds futures for December from a 40% probability of a 0.25% rate cut to 75%.

The earnings reporting season is almost complete with over 95% of companies in the S&P 500 Index having reported. This week has 12 companies in the S&P 500 Index scheduled to report results. Third quarter S&P 500 Index earnings growth is forecast at 13.4% with revenue growth of 8.4%. This is a large increase from the 8.0% earnings growth and 6.3% revenue growth for the quarter expected at the start of the earnings period last month. Full-year 2025 earnings are expected to grow by 11.8% with revenue growth of 6.8%.

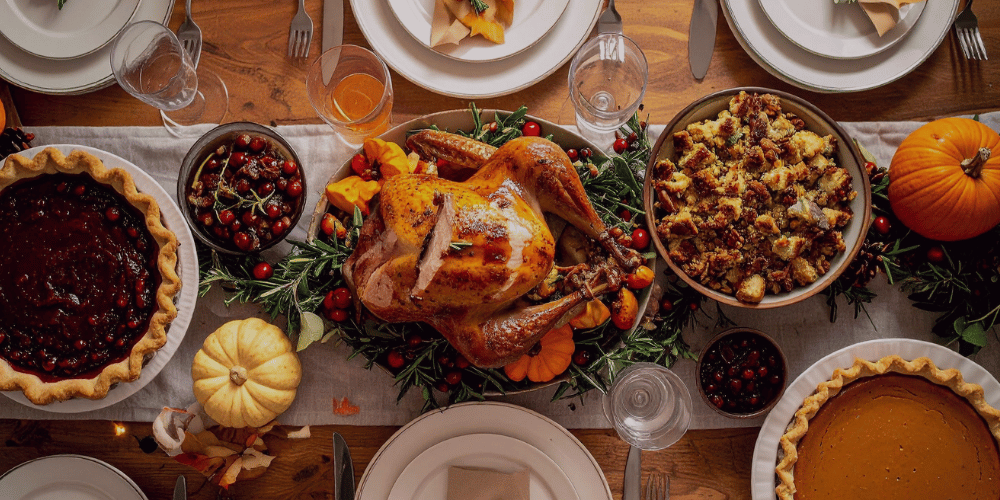

In our Dissecting Headlines section, we look at economic data of Thanksgiving to include the cost of the turkey dinner and holiday travel plans.

Financial Market Update

Dissecting Headlines: Thanksgiving Economics

Based on data from the Farm Bureau, the cost of this year’s Thanksgiving dinner for ten people is $55.18, 5.0% lower from 2024 and 9.8% lower from 2023. This is the third year consecutive year prices have declined. The biggest factor decreasing prices this year is the 16-pound frozen turkey, costing just $21.50, or $1.34 per pound, a 16.3% decrease from last year. Other items that saw a decrease in price were dinner rolls and stuffing due to low wheat costs which brought down the price of flour. However, fresh vegetables and sweet potatoes increased in price partly due to natural disasters, labor shortages, and supply-chain disruptions.

AAA projects 81.8 million people will travel at least 50 miles from home over the Thanksgiving holiday period from Tuesday, November 25th to Monday, December 1st. This is an additional 1.6 million travelers, or 2.0% increase, compared to last Thanksgiving, setting a new overall record. The overwhelming majority of travel will be by car with AAA projecting at least 73 million people, approximately 90% of total Thanksgiving travelers, taking to the road, a 1.8% increase. At the pump, drivers are paying about the same as last year with the national average for a gallon of regular gasoline at $3.07 versus $3.06 last year. Just over six million U.S. travelers are expected to take domestic flights over the Thanksgiving period, a 2.2% increase year-over-year. Travel by other modes is expected to increase by 8.5% to nearly 2.5 million people. Those travelers are taking trips by bus, train, and cruise. We could see a slight shift to higher car, bus, and train from air depending if travel plans have changed due to recent flight cancellations.

Safe Travels and enjoy the Thanksgiving holiday!